Let’s talk about tax.

Or more particularly let’s continue to talk about the IRD restructure.

There are so many things I would rather talk about: how charities don’t have to distribute; exactly what was Roger Douglas going on about; and Labour Party’s family package.

But last week’s post was really a rant. And I don’t like ranting. So I thought this week I’d take a more considered look. In large part to work through how exactly had I got Business Transformation just so wrong?

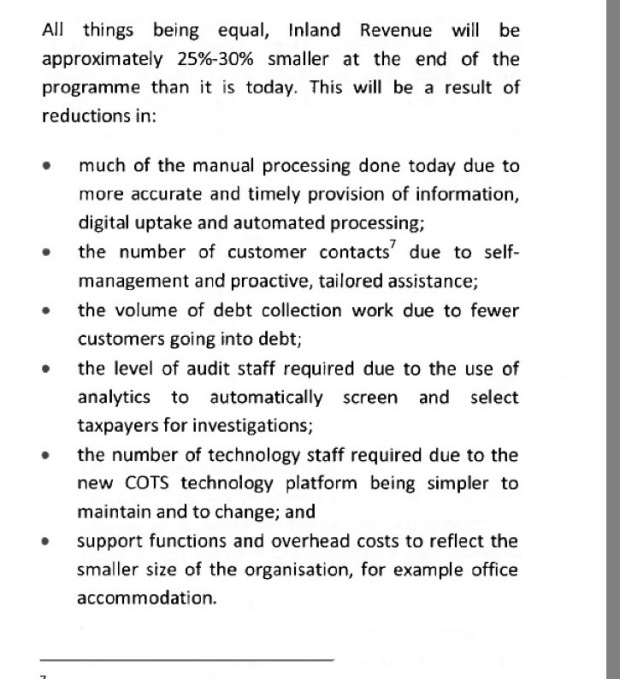

The Business Case signed off by Cabinet was a reasonable place to start. Except didn’t that simply say in the brave new world there would be fewer errors, less manual processing, and fewer IT staff? And aren’t these customer facing people the ones being confirmed in their jobs?

And yes it did talk about a reduction in audit staff because there would be better screening. But that always seemed reasonable. Less low end work consistent with a more knowledge based department.

But then I had a look at what actually said:

Now with the dot point on audit staff, I had thought that level was simply a synonym for number or volume. You know – the words that had been used in the other dot points. Using level makes the language less repetitive as any good editor will do.

But looking and thinking again – level is also a synonym for grade or capability. And this is exactly what is happening. A reduction in the pay bands of the senior people is due to a reduction in the capability required across the audit cohort.

HR 101.

So right from the start – the information was always there. Hiding in plain sight. Just as well I am no longer employed for my ability to do detail.

One thing though that is very clear in the restructure is just how important data analytics people will be in the department. So important that in the specialist group only about a quarter of the positions are for tax technical people. So important that it appears the additional technical people referred to in the Commissioner’s press statement are data intelligence people.

Ok. Fair enough. But while these people and the flash new computer could be very helpful in identifying issues; resolving them – not so much.

So why is the department tilting its focus in this way? Over the last week I have been (over) thinking about this and this is what I have come up with. It’s not great but it is the best I can do.

Everything is ok – and if it’s not – service will fix it

When I rejoined the department in 2015 there was a theme of Right from the Start. This came from OECD work in 2012 of the same name. The gig was simply – for small and medium businesses – it is better for revenue authorities to help them get it right from the start rather than audit non or poor compliance. In large part – stating the flaming obvious but it was a good way to think about allocating resources. I was – and still am – very supportive of this approach.

From time to time I would hear that RFTS could ultimately mean – no audits – for anybody large or small. But as that was just silly I didn’t pay much attention to it. The OECD work after all was all about small businesses for whom the tax law can get a bit overwhelming. It didn’t apply to the types of big business that actively structure into the tax law.

Or so I thought until last December when the Large Enterprises Update came out using RFTS language. Largely harmless I thought and mostly a rebadging of the long standing direct compliance work undertaken by Senior Investigators in the Large Enterprises section. I then clicked through to the Multinationals Compliance Document. Again largely a standard breakdown of the issues worked on by the section.

What did catch my eye was the foreword from the Commissioner. In it she said:

The 600 largest taxpayer groups, whose tax affairs we review every year, contribute more than $6 billion tax to NZ annually.

But this is no time to rest on our laurels. Internationally there are serious challenges in collecting tax from multinationals. New Zealand needs to play our part in addressing that. And while I am confident that most are paying the tax they should in New Zealand, the public appears less convinced. We each need to conduct ourselves in a way to correct that misperception.

Mmm $6 billion. Possibly includes a large slice of PAYE and GST which is more collected than contributed. But I digress.

Oh right. So everything is ok. Good to know.

Not exactly sure why then there are at least three discussion documents on the problems with international taxation. And even with all that the Leader of the Opposition is writing to companies telling them to get their tax act together.

Of course who were the people that uncovered the issues in the first place? Yes you guessed it. The audit staff whose level is being reduced.

But the computer is like really smart

Now the other thing I haven’t really factored in is just how useful a super smart computer will be for finding risks and doing stuff. And maybe if the lawyers aren’t messed around too much, maybe they with the lower level Investigators – or Customer Compliance Specialists as they will become – can do the job. Particularly if the computer is like totally wicked.

Maybe.

But computers can’t work without material. And what they currently have for large business is the Basic Compliance package which includes financial statements. This is cool but financial accounts are prepared for their shareholders and it is all about communicating information to them. One company’s accounts can follow a different format and structure to another company.

So some person at IRD will still need to do something to turn this into comparable information.

In all the BT stuff that has come out – I haven’t seen anything that requires/mandates business information to be provided in a particular format. And in terms of public stuff remember now even Facebook doesn’t have to file accounts. So for big companies IRD has the most information. And that is currently financial accounts following a non-standard format.

But maybe – you know – machine learning or Artificial Intelligence can sort this out. HMRC is apparently getting into it. In areas that include case work – ‘to enhance decision making’. Great. Good to know.

A tax accountant, however, commenting in that article is less convinced. Because facts and circumstances.

But then dear readers – much like this tax accountant – let’s just hope it is her lack of imagination. And it is all part of a well thought out plan. Fingers crossed.

Andrea

Very good column Andrea.

Reads like a whodunit! And you found the incriminating evidence – “level”.

Arrant nonsense of course that you can reduce the grade of investigator when tax rules are getting if anything more complicated. Have the BT decision-makers read the BEPS discussion documents?

The billion dollar audit cases like the successful banking ones were initiated and run by high not lower level investigators.

I don’t see this ending well for the country.

LikeLiked by 1 person

I am sorry to say I agree with you. I am also concerned that as this is an ‘operational’ issue there is nothing much that external parties such as the Minister can do.

LikeLike

I still agree with another readers’ comment on your last post. Surely this is minister-led? Nationals’ way of making life easier for big business? I can’t think of any other reason why the Commissioner would think that MNC’s are doing their best to pay a fair amount of income tax.

From a practical point of view as a practising accountant, the new computer system sucks (it is so not user-friendly) and the level of service from IRD (both phone and secure mail) has nose-dived the last 1-2 years.

So i’m not holding high expectations for the future if this is the path they are going down.

LikeLike