This week the Government released a discussion document on a form of emissions pricing for new and imported vehicles. Pretty much on cue the opponents were railing against this ‘tax’ thereby bringing it into scope for this blog.(1)

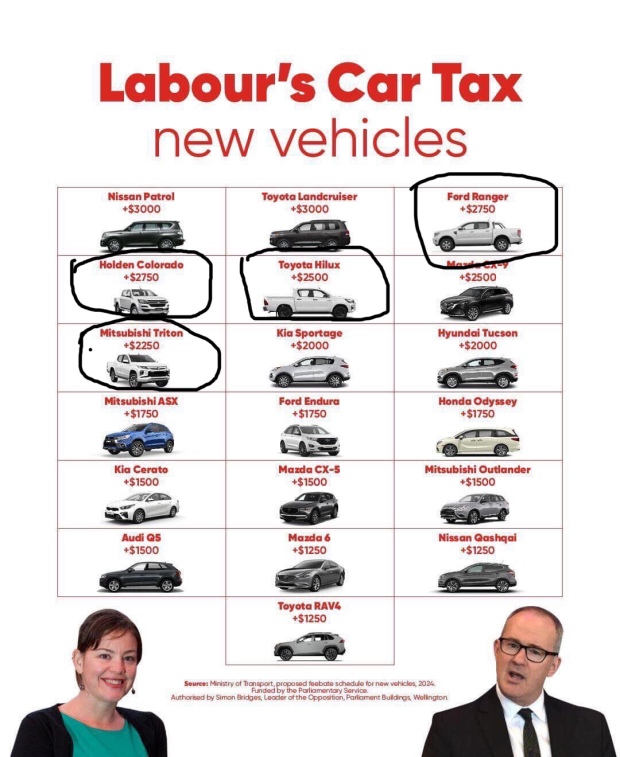

[The reason for the badly drawn boxes will become clear in a bit. I can assure the Leader of the Opposition that they have nothing to do with poor graphic design on the part of the National Party Research Unit.]

The idea is that heavy emitting vehicles would pay a charge and low emitting vehicles would get a subsidy. While they were aimed to broadly net off there is likely to be a net cost which the Government will need to appropriate as a reserve fund to keep it all moving (2).

As an aside my former tax policy self can’t help feeling what is proposed in the discussion document is all a bit technically perfect and could possibly be simplified without losing too many of the behavioural benefits. (3)

But implicit in all of this is that there is some sort of market failure or unpriced externality as New Zealanders, more than other countries, seemed to value a low capital cost highly even if it involved higher running costs.

I guess then in a ‘if you can’t beat them join them approach’ the deal is that the government will marginally bring down the capital cost of low emitting, low running cost vehicles. Giving net benefits of between $111 and $821 million being largely a reduction in fuel costs from people driving more fuel efficient cars.

I haven’t fully nailed this yet as conceptually on an npv basis if low emitting cars have lower running costs the net benefits should stand on their own without government intervention. So I am wondering if there is something in a lack of personal savings to fund the higher capital cost or a bias against potential loss of value v operating costs that is influencing these decisions. (4)

Regardless it seems to be a microcosm of the environmental tax proposals in the Tax Working Group. There the proposals were that any money raised from additional taxation was used to fund the transition to greater environmental sustainability. (5)

As here it was a bit loose. Revenue recycling was the term used rather than hypothecation as it gave the Government the ability to also put money into any transition programme and so not be constrained by the funds actually raised.

And much like most of the environmental proposals in the TWG report – behavioural benefits are the name of the game. Rather than revenue raising.

And much like all behavioural taxation and subsidies – whether they have any actual effect will depend on the elasticity of demand for such vehicles (6). Because if demand is:

- Very elastic – price sensitive – the $8000 benefit v $3000 cost will see a massive swing away from high emitting to low emitting vehicles. There will be no revenue raised and it will cost the Government a packet.

- Elastic ish – it will have an effect but there will still be high emitting cars purchased. This is useful if the Government wants minimise it’s contribution to the overall cost.

- Inelastic – price insensitive – there will be little or no change as people love their big emitting cars. On that basis it would start to become more like tobacco excise and become a good little earner for the Government. For the planet – not so much.

Now in the cabinet paper there is a list of other complementary things the government is doing (7). But curiously there is nothing on tax other than the RIS correctly ruling out a GST exemption for electric cars. Maybe it was because the Ministry didn’t consult with Inland Revenue (8) as I would have hoped the Department could have explained to them how environmentally unneutral fringe benefit tax (FBT) is.

Fringe benefit tax and the environment

The deal with fringe benefit tax is it taxes fringe benefits – such as ‘free’ cars or cheap loans – given to employees. The idea is that then there will be a tax level playing field to receiving cash wages and non-cash fringe benefits such as cars. FBT is an OG promoter of tax fairness as non-cash benefits are more likely to be given to higher income people.

However for completely unintentional reasons, in two ways, this tax could be incentivising the wrong things from an environmental perspective.

Carparks v public transport

The first is there is effectively no fringe benefit tax on the employer provision of car parks. This arises initially through an explicit exemption for any benefits provided on the employer’s premises.

The employer’s premises exemption make sense for compliance cost reasons as how do you work out the value of a benefit that is all part of the employer’s cost of running the business. So seems fair enough.

But when this meets car parks, the Department’s interpretation is that any leased land forms part of an employer’s premises.

And guess what – carparks are now all leased. Who would have thought!

There have been at least two attempts – one under Michael Cullen and another under Bill English – to legislatively remove this exemption. Both failed.

So rather than get on that horse again – as part of its environmental work – the TWG recommended that the government consider also removing FBT from the provision of public transport (9). To level the environmental – if not the tax – playing field.

Double cab utes and the work related vehicle

The second relates to double cab utes and the work related vehicle exclusion. See I told you my vandalising of the National Party’s work would become relevant.

[TL:DR The vandalised pictures would all meet definition of a work related vehicle – if signwritten – and be exempt from fringe benefit tax.]

A bit like the on premises exemption for car parks, there is also an exemption for work related vehicles. Again that makes sense for compliance cost reasons as there is not much private value from getting to take a work ute home.

In the late 80’s when I worked for a Chartered Accountant, the rules around work related vehicle were that it needed to be signwritten and it needed to have the back seats taken out of any vehicle that had more than two seats. I have very strong memories of the partner I worked for arguing with clients about how non negotiable both requirements were.

Now the rules seem to be that the vehicle is not ‘designed mainly to carry people’. (10)

I have been told that some time in the early 90’s the Department’s interpretation of this went from ‘take out the back seats’ to ‘double cab utes ok’.

Now for a sole operator tradie the need for the back seats may be a bit of a stretch as a requirement for a work related vehicle but is arguably ok. However I seriously struggle with a shareholder employee that runs the office and does the books having an FBT exempt dual cab ute. And yet that is exactly what is possible and completely legal.

All costs of the vehicle are tax deductible if the employer is a company and no FBT is payable.

So until there is a change to this I would suggest that the $3000 will simply be paid as it is less than the possible FBT that would otherwise be paid (11). In fact assuming no actual work related use or employee related expenditure any double cab ute that costs more than $31,000 it would make sense to just pay the $3,000. (12)

So may be this is revenue raising after all?

Andrea

Update (25/7/19)

Inland Revenue have kindly reached out to me to point out I overlooked a subsection – not the first time that has happened – and so office workers could not get the work related exemption if they had a sign written double cab ute.

I accept their analysis and accept that there is nothing in the law or its interpretation by Inland Revenue – as they have outlined it – that is driving the double cab ute phenomenon.

However it would be good to know how much FBT – or personal use adjustments – actually arises from personal use of the double cab utes. Because the ones I see aren’t even sign written.

(1) Long term readers will know this is nonsense as I will write on anything that spins my wheels.

(2) Paragraph 141 of Cabinet Paper.

(3) My former tax policy self also couldn’t help noticing options that looked awfully like tax pooling. The firms who offer that must currently be creaming it given the recent use of money interest rates. But that is a story for another day.

(4) Strictly speaking income tax also shouldn’t be a thing here as operating costs are tax deductible as is any interest expense and the capital cost is depreciable over time. It might conceptually be possible that the tax depreciation understates the actual depreciation but at 30% DV/21% straight line it doesn’t feel material or likely.

(5) Page 53 Paragraph 127

(6) Elasticity of supply will also feature in the final outcomes. If there is any form of constrained or monopolistic supply then the benefits could be absorbed by the supplier but with the costs passed on to consumer.

(7) Paragraph 35

(8) Paragraph 126

(9) Recommendation 18

(10) Section CX 38 of Income Tax Act 2007 and definition of car.

(11) 49.25% of 20% of cost price at say $45000 is FBT foregone of about $4.5k.

(12) Working backwards to a FBT cost of $3000, gives about $30,500.

I suspect demand will be inelastic (price insensitive). There are probably a lot of reasons why many NZers favour the big emitters. Safety is one – much of our open road travel is on two lane death traps – ability to accelerate quickly to pass is an important safety feature. We likely have more lifestyle blocks per capita than elsewhere. NZers like to tow stuff – we probably have a very high per capita number of boats to other nations. NZers have some big families, and lots of blended families, and families that cart the kids friends to sport and other activities in leisure time, and hence, have call for more than 5 seats. NZers have greater opportunities for 4WD/off road activities given our coastal landscapes and open spaces. I suspect this will turn out to be a tax discount to the oldies, paid for by the younger generation.

LikeLiked by 1 person

If you want to accelerate quickly to pass, why would you buy a SUV? They are heavier, hence slower, and higher centre of gravity equals poor handling. A sedan is going to accelerate and complete the passing manoeuvre with much more comfort.

LikeLike

Need to think carefully on this stuff. Everything capitalised into prices now. So gas guzzlers become more expensive. Big bonus for this with SUVs. Electric cars second hand drop in price. Bad for them. In meantime electric cars still expensive so by no means buy one now. Wait for forthcoming government subsidy. Is this the intended message. Bonus for gas guzzlers and do not buy electric for a few years. Economics can be cruel on the well intentioned. Need to think not just feel stuff.

LikeLiked by 1 person