Last week the Small Business Council issued its report to Government. I am sure there are many wizard things in there maybe even some tax recs.

Also last week I had a friend to stay who is helping some workers that have lost thousands of dollars of wages and holiday pay when their employer went into receivership. Her expression was Wage Theft. It is a crime in Australia but not in New Zealand. Unlike theft as a servant which totally is.

Talking to her it was obvious that there was considerable overlap between what she is seeing and the issues considered by the TWG of closely held companies where the directors have an ownership interest not paying PAYE and GST (1).

And yes my friend’s friends are worried about their PAYE and KiwiSaver deductions. So really hope tightening up on this stuff is in the Small Business report along with the expected recs on compliance cost reduction.

I am also personally very interested in what the Group comes up with as the Productivity Commission noted that NZ has a lot of small low productivity firms without an up or out dynamic (2). That is firms tieing up capital that should be released for more productive purposes with the associated benefit of not staying on too long and dragging their workers and the tax base with them.

Now ever since I found that reference I have been concerned that there may be aspects of the tax system that may be driving that. Benefits or ‘opportunities’ that don’t arise for employees subject to PAYE or owners of widely held businesses subject to audits and outside shareholder scrutiny.

And it is true that there is nothing particularly special in a tax sense here to New Zealand. However given that New Zealand rates as number one in the ease of doing business index there may be more people going into business than would be the case in other countries.

Some of these aspects can be reduced through stricter enforcement by Inland Revenue but are otherwise largely structural in a self assessment tax system where the department doesn’t audit every taxpayer. One is a policy choice possibly because the alternative would add significant complexity to the tax system and the final example is a combination of the need for stronger enforcement and/or policy changes needed now that the company and top personal rate are destined to be permanently misaligned.

So what are these ‘aspects’?

Concealing income or deducting private expenses

Recent work by Norman Gemmell and Ana Cabal found that the self employed had 20% higher consumption than the PAYE employed at the same levels of taxable income.

Now it could be that for some reason the extra consumption of the self employed comes from inheritances or untaxed capital gains or taking loans from their business – more on that later – more so than those in the PAYE system or owners of widely held businesses. It might not be tax evasion at all.

But we just don’t know.

All we know is the 20% extra consumption and that there is a greater opportunity and fewer checks with closely held businesses to conceal income or deduct personal expenses. And Inland Revenue says such levels are comparable with other countries.

While things like greater withholding taxes and/or reporting can help, I am also concerned that with greater automation it also becomes much easier to have those personal expenses effortlessly charged against the business rather than recorded as personal drawings.

Interest Deductions

The second aspect is my specialist subject of interest deductions. Unlike concealing income or deducting personal expenditure – this one is totes legit.

Interest is fully deductible to a company and for everyone else it is deductible if it can be linked to a taxable income earning purpose or income stream aka tracing.

What that means is if a business person has a house of $2 million and a business of $1 million and has debt of $1 million – all the interest deductions on the debt can be tax deductible – if the debt can be linked to the business. This can be compared to a house of $2 million and debt of $1 million – and no business – where none of it is deductible.

To make this fairer with taxpayers who don’t have the opportunity to structure their debt there would need to be some form of apportionment over all assets – business and personal. So in the above example interest on only $330,000 should be allowed.

But yes – that would require a form of valuation of personal and business assets. And yes valuing goodwill brings up all the same – valid – concerns raised with taxing more capital gains.

So I guess we can say that under the status quo fairness – and possibly capital allocation – have been traded off against compliance costs.

Income Splitting

The third is the ability to income split with partners to take advantage of the progressive tax scale. Now this is only actually allowed if the partner is doing work for the business. But verifying the scale and degree of this work – even with burden of proof on Commissioner – is a big if not impossible task for the Commissioner.

Other mechanisms include loans from the partner to help max out the lower income tax bands.

And the statistics would support an argument that there is a degree of maxing out the lower bands just not that there necessarily is a lot of income splitting.

Interestingly both Canada and Australia have rules for personal services companies where these types of deductions are not allowed.

But this is ok if this is the amount of value going to the shareholders. Maybe our firms are so unproductive that they can only support shareholder salaries of $70k and below.

If that were the case though we wouldn’t be seeing the final aspect which is taking loans from companies you control instead of taxable dividends.

Overdrawn shareholder current accounts

Now to be fair for this to occur there should also be interest paid by the shareholder to the company on loans from the company to the shareholder. And unlike the interest in point 2 – none of this should be tax deductible to shareholder if it is funding personal expenditure while the interest received will be taxable. This on its own should be enough to not do it and receive taxable dividends instead.

Unfortunately the facts also don’t seem to back this up. Imputation credit account balances – meaning tax has been paid but not distributed- have been climbing. Now this could be like totally awesome if it meant all the money was being retained in the company to grow.

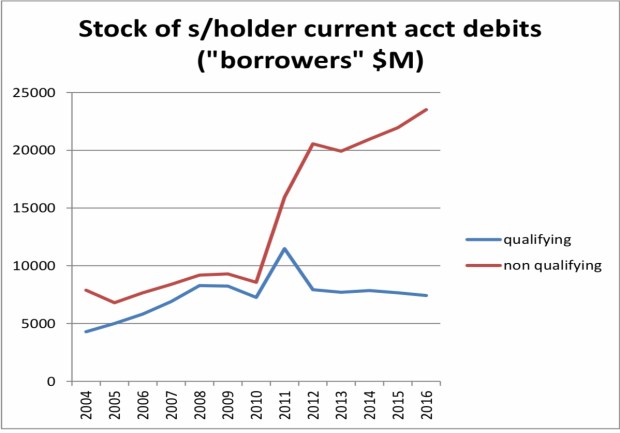

Except that overdrawn current account balances – loans from the company to the shareholders- have been similarly growing too. Now sitting at about $25 billion.

And yes this all started from about 2010. And what happened in 2010? Why dear readers the company tax rate was cut to 28% while the trust rate remained at 33%.

Ironically the associated cut in top marginal rate was to stop the income shifting that went on between personal income and the trust rate.

Now one level it shouldn’t matter at all if these balances continue to climb so long as non- deductible assessable interest is paid on the debt. However an overdrawn current account is – imho – the gateway drug to dividend avoidance.

And yes that can be tax avoidance but much like the tax evasion opportunities, income splitting and interest on overdrawn current accounts – all of this requires enforcement by Inland Revenue. And as they can’t audit everyone there will always be a degree that is structural in a self assessment tax system.

But the underlying driver of people wanting to take loans from their company rather than imputed dividends is that our top personal tax rate and company tax rate are not the same. Paying a dividend would require another 5% tax to be paid.

Possible options

Now other countries have always had a gap between the top rate and either the company or trust rate so this shouldn’t be the end of the world. But those countries have buttressing rules that we don’t have in New Zealand. The personal services company rules discussed above or the accumulated earnings tax in the US (3) or the Australian rule that deems such loans to be dividends.

Until recently I had been a fan of making the look through company rules compulsory for any company that was currently eligible. (4) I couldn’t see the downside. The closely held business really is an extension of its shareholder so why not stop pretending and tax them correctly.

However some very kind friends have been in my ear and pointed out the difficulties of taxing the shareholder when all the income and cash to pay the tax was in the company. It works ok when it is just losses being passed through. So maybe I am less bullish now.

An alternative approach could be to apply a weighted average of the shareholders tax rates on the basis that all the income would be distributed. Similar to PIEs. The tax liability is with the entity but the rate is based on the shareholders. I guess you then do a mock distribution to the shareholders which can then be distributed to them tax free. And yes only to closely held companies. Wider would be a nightmare.

Kind of a PIE meets LTC.

Or you could just old school it and raise the company tax rate to 33% for all companies. Shareholders with tax rates below that could use the LTC rules and make the assessment of whether the compliance of the rules was greater or less than the extra tax.

It would require an adjustment to the thin capitalisation rules by increasing the deductible debt levels to ensure foreign investment didn’t pay more tax. But for some of you dear readers increased taxation on foreign investment might even be a plus.

But all in all I don’t think the status quo with small business is a goer. Whether it is for fairness reasons, or capital allocation reasons or simply stopping me worrying – doing something is a really good idea.

Because I would hate to think any of this was enabling behaviours that kept people in business longer than they should. And even with the most whizziest of new IRD computers – there will always be limits on enforcement.

Andrea

(1) Page 116 Paragraph 68

(2) Page 19

(3) Although it would make more sense to only apply this to the extend that the income hasn’t been retained in the business and distributed in non- dividend form.

(4) Yes there is the issue that companies could start adding an extra class of share to get around this. But I don’t believe this is insurmountable with de minimis levels of additional categories and the odd antiavoidance rule for good measure. It is even the advice of KPMG so clearly not that wacky.

I am confused re shareholder current accounts. You talk of overdrawn current accounts and produce data on debit current accounts. Get that – this is a shareholder extracting cash from company by way of loan. IRD does not like this – we have rules on it. Interest must be charged and tax paid by the company. You seem to suggest the shareholder should get no interest deduction. But the shareholder gets an interest deduction only if the loan from the company is used to invest for taxable income (not if used to buy the home). Why should it not be deductible if it meets the nexus test?

But your text talks of loans from shareholders to the company. This is the shareholder putting money INTO the company – investing not taking money out. NO interest need be charged naturally. But you seem to want to deny interest deductions again I think. Why? I agree that credit current accounts (these things) can arise from dividend stripping – but that is only when there is dividend stripping which has its own rules. Not when I lend the company money to buy machinery.

You seem to want to penalise the case when shareholders lend to or from the company. Given that shareholder current accounts seldom have a zero balance (especially outside balance date) that seems harsh and odd.

Confusion may be all mine but I am confused.

LikeLike

That’s fair re deduction. I was working on assumption that loan was to fund private expenditure. I am completely relaxed if it is funding taxable income.

The debit balance description is annoying. It is officials description of overdrawn current accounts. Although I guess strictly speaking they are debit balances in the accounts of the company.

Meant to discuss loans from company to shareholder. Have no view the other way. Completely relaxed about that.

Will review text and come back.

LikeLike

Made a couple of clarifications but couldn’t find any reference of loans from shareholders to the company.

LikeLike

Hi Andrea. Re- corporate veil and PAYE defaults. It’d be good if there was a personal liability for such deductions from wages as per the Australian system mentioned in the paper. There is some recourse: any shortfall penalty imposed can be apportioned to an officer of the company. In addition, a shareholder employee that has PAYE is deducted and not paid will not get a tax credit against their income tax liability.

Do you know if deductions of Kiwisaver employee deductions (NOT employer contributions) from a s/h employee that are not paid to IRD are guaranteed by the Crown as they are for non-shareholder employees (and associated persons)?

LikeLiked by 1 person

Hi Ray. The TWG made a recommendation exactly on the lines you are suggesting. On your other point it looks like it wont apply to shareholder employees unless they are in the PAYE system.

http://www.legislation.govt.nz/act/public/2006/0040/151.0/DLM379043.html

LikeLike

Stamping down on the kiwi dream of working for yourself is almost as bad as taxing the family home :-p

LikeLiked by 1 person

That is an excellent analogy. I’ll keep with the worrying then.

LikeLike