Last week sometime I found myself in a Twitter discussion with PEPANZ – of all people – as they were saying the TWG had supported the recent extension of the tax exemption for oil rigs. It is an exemption that is theoretically timelimited for non-resident companies involved in exploration and development activities in an offshore permit area. Theoretically because it will have been in force for 20 years if it actually does expire this time.

Having been a little involved with the TWG – as well as the Treasury official on the last rollover – I was somewhat surprised by PEPANZ’s comment. But in the end they were referring to an Officials paper for the TWG rather than a TWG paper per se. A subtle and easily missed difference.

And one they unfortunately also made in their submission to the Finance and Expenditure Committee (1). Although it was a little odd that they needed to make a submission as everyone has known for 5 years that the exemption was expiring.

But in that thread PEPANZ encouraged people to read the Cabinet paper and so for old time sake I did. The analysis was quite familiar to me but the thing that gave me pause was the fiscal consequences were said to be positive.

Yes positive.

Implementing a tax exemption would increase the tax take. A veritable tax unicorn.

No wonder it had such support. I guess this exemption will now have to come off the tax expenditure statement.

Personally I am not a fan of this exemption or its extension. And although I accept the prevailing arguments – much like the difference between a paper for the TWG and a paper of the TWG – it is less clear cut than it seems.

International framework for taxing income from natural resources

Now followers of the digital tax debate will know all about how source countries can tax profits earned in their country if these profits are earned through a physical presence in their country aka permanent establishment. And because it is super easy to earn profits from digital services without a permanent establishment there is a problem.

However for land or natural resource based industries a physical presence is – by definition – super easy.

And if you properly read treaties there is a really strong vibe through the individual articles that source countries keep all profits from its physical environment (2) while returns from intellectual property belong to the residence or investor country.

So before tax fairness or stopping multinational tax evasion was a thing, there was source country taxing rights based on natural resources.

Then to make it super super clear Article 5(2)(f) of the model treaty makes a well or a mine a permanent establishment just in case there was any argument.

To be fair to our friends the visiting oil rigs, other than the physical environment vibe there is no actual mention of exploration in the model article. But the commentary says it is up to individual countries how they wish to handle this. (3)

What does New Zealand do?

The best one to look at is the US treaty. In that exploration is specifically included as creating a permanent establishment but periods of up to 6 months are also specifically excluded (4).

This is interesting for two reasons.

First the negotiators of the treaty clearly specifically wanted exploration to create a taxing right as this paragraph is not in the model treaty. Secondly it stayed in the treaty even after a protocol was negotiated in 2010. That is if this provision and the 6 month carve out were a ‘bad’ thing for New Zealand it would have made sense for it to have come out at that point. Either unilaterally or as a tradeoff for something else.

So in other words anything to do with the taxation of oil rigs involved in exploration cannot be considered to be a glitch with the treaty that could be fixed with renegotiation. Unless of course it was oversight in the 2010 negotiations.

What are the facts?

The optimal commercial period for these rigs to be in New Zealand seems to be about 8 months. That is two months or so too long to access the exemption. But rather than pay tax they will leave and another rig will come in with associated extra costs and environmental damage.

This is what was happening before the exemption came into place in 2004 and so does prima facie seem a reasonable case for just having an outright exemption. However:

The 2019 Regulatory Impact Statement says that the contracts have a tax indemnity clause meaning that any tax payable by the non-resident company must be paid by the New Zealand permit holder. (5)

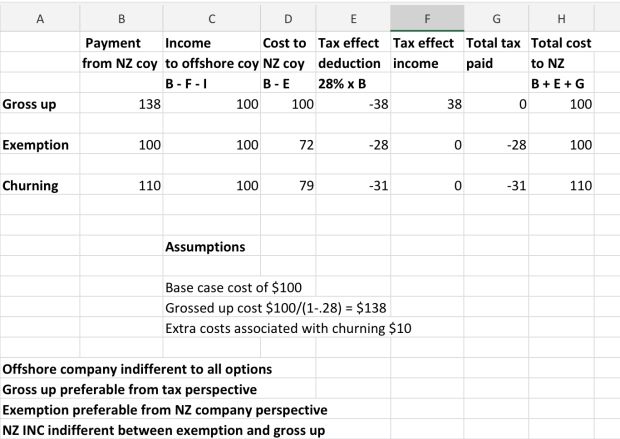

This means that the outcomes would be broadly similar to this table. This is on the basis that rigs could be substituted albeit with delay at additional cost rather than exploration simply being deferred to another year. (6)

Why don’t I like the exemption?

Much like the difference between TWG reports and reports for the TWG it is all pretty nuanced.

Pre 2004, as there were tax indemnities, the only reason to have the rigs leave and another one come in was if the cost to the company of the churning was less than the cost – paying the tax – of the rig staying put.

However while that would be a completely reasonable business decision for the company it is highest cost for the country as a whole and the highest cost to the tax base of all the options.

And so the argument for an exemption was framed. An exemption lowers the cost to the Crown and also to the company. Win Win.

However the tax base does best in a world without the exemption but where the rigs stay put and the company pays the non-resident operators tax.

Now requiring that would be somewhat stalinist but it does feel that Government has had its hand forced when it wasn’t party to any of the original decisions. The Government has no control over the cost structure of the industry but:

- Needs to exempt income of a class of non-resident at a time when it is looking to expand taxing rights over other non-residents;

- Weakens its claim on the tax base associated with natural resources,

- Gets offside with a major stakeholder of its confidence and supply partner.

And all of this is before you get to the precedential risk associated with moving away from the otherwise broad base low rate framework. Which by definition involves winners and losers.

I am also not convinced by the revenue positive argument. The RIS states that as the exemption has been going on forever the forecasts have already factored in the exemption (7). This means an extension of the exemption has no fiscal effect.

However by the time it gets to the Cabinet Paper – albeit close to a year after the RIS was signed off – a $4 million cost of not extending the exemption has now been incorporated into the forecasts (8). And so – hey presto by extending the exemption – an equivalent revenue benefit arises that can go on the scorecard (9). From which other revenue negative tax policy changes can be funded.

Every Minister of Revenue’s dream.

So like I said – not a fan. There is a narrow supporting argument. Absolutely. But the whole thing makes me very uncomfortable. To make matters worse – it is only extended for 5 years. It hasn’t been made permanent. Even after 20 years. SMH.

Hope I am doing something else in 5 years time.

Andrea

(1) Curiously officials write up of the submission in the Departmental report page 171 is far more fulsome than the written submission. I guess it must reflect an empassioned verbal submission from PEPANZ.

(2) Article 6 of the model treaty makes this explicit without any reference to a permanent establishment.

(3) Paragraph 48 Page 128

(4) Article 5(4)

(5) Paragraph 6. This comment isn’t the the recent RIS but as the analysis is based around the New Zealand permit holder wearing the additional costs associated changing the non-resident operator it is reasonable to assume that equivalent clauses are in the new contracts.

(6) Section 2.3 of RIS discusses the delays associated with changing operators.

(7) Page 11

(8) Paragraphs 21-23

(9) Section 4.6