Goodbye again

Hello everyone

I realise I just disappeared on here so I thought I’d update you on my new whereabouts and then sign out.

I am currently the Policy Director and Economist for the NZ Council of Trade Unions. So blogging is off the agenda for the foreseeable future.

However I am still writing about things and publish a monthly economic bulletin. To date I have published one in January and February for the CTU. It comes out on the last day of the month.

I have published a tax piece for interest.co.nz, been interviewed by the NBR and was on the telly on Q and A.

I still have lots of reckons. Some of which include tax and can be found on Twitter @andreataxyoga and LinkedIn https://www.linkedin.com/in/andrea-black-0b2490123/

But for anyone who would like to obtain an emailed version of my monthly views for the CTU – options include:

1) Leave your email address in the comments section. I am moderating all comments so it won’t be public or

2) Email me on andreab@nzctu.org.nz.

Either way I’ll add you to the distribution list.

But you’ve been a great audience and I have appreciated all the engagement. It has all been such a pleasure.

Kia kaha

Andrea

Tax and small business (2) – company tax rate

Last week was a big week for your correspondent.

On Wednesday I got to upgrade my CA certificate to a FCA one at a posh dinner at Te Papa. As a third generation accountant I was absolutely tickled pink by that.

Interestingly of the 12 Wellington people there were 5 tax people: Me, Mike Shaw, Suzy Morrissey, Stewart Donaldson and Lara Ariel. All except Lara I have had the great pleasure to work with personally and professionally over the years.

I got to give a wee talk and so thanked my Wakefield (mother’s accountant line) genes; the balance sheet for being able to distinguish between the concept of capital as an asset or net equity – a framework other professions lack; and Inland Revenue Investigations as both the employer of my proposers and the place of some of the highlights of my personal and professional life.

I gave a slightly longer talk on the Tuesday. Twelve minutes instead of two.

The theme of that seminar was options to improve fairness now that extending the taxation of capital gains was off the table. The punchline of my talk was that the company tax rate should be raised.

I had come to that point following lots of feedback on my tax and small business post.

Very experienced tax people were sympathetic to my concerns but the ideas of mandating the LTCs rules or restricting interest deductions or even a weighted average small company tax rate sent them over the edge with the compliance costs involved. Their preference was that it was just simpler all round to increase the company tax rate with adjustments such as allowing the amount of deductible debt for non-residents.

And so on Tuesday I had a go at putting that argument.

Clearly not well as Michael Reddell described the argument as cavalier given NZ’s productivity issues.

Regular readers will know I am concerned about whether the tax system is a factor in New Zealand’s long tail of unproductive firms without an up or out dynamic. And that is before we get to any well meaning – but not always hitting the mark – collection of small companies tax debts inadvertently providing working capital for failing firms.

Although I had twelve minutes to talk on Tuesday, the company tax punchline really only got a minute or two to expand. So I’ll try and have a better go at it here. (1)

Now before we get to the arguments in favour of a company tax increase, Michael referred to this table as prima facie indicating that business income is not overtaxed.

Yep.

This table absolutely shows that second to – that other well known high tax country – Luxembourg, New Zealand’s company tax take is the highest in the OECD as a percentage of GDP.

My difficulty is that – in a New Zealand context – I struggle to call the company tax collected – a tax on business income.

Absolutely it includes business income.

But it also includes tax paid by NZ super fund – the country’s largest taxpayer and Portfolio Investment Entities which are savings entities. In other countries such income would be exempt or heavily tax preferred. And yes I know there are arguments about whether they are the correct settings or not but all that tax is currently collected as company tax.

Also, for all the vaunted advantages of imputation, the byproduct of entity neutrality is the potential blurring of returns from labour and capital for closely held companies. So – and particularly with a lower company than top personal rate – there will always be income from personal exertion taxed at the company rate.

And business income is also earned in unincorporated forms such as sole trader or partnership. All subject to the personal progressive tax scale rather than the flat company rate.

Australia’s company tax is also high but less so. Possibly a function of their lower taxation on superannuation than New Zealand or even that such income is classified according to its legal form of a trust.

And all that is before we get to issues like classical taxation in other countries encouraging small businesses to choose flow through options to avoid double taxation. An example is S Corp in the US. Tax paid under such structures will not be shown in the above numbers as the income is taxed in the hands of the shareholders.

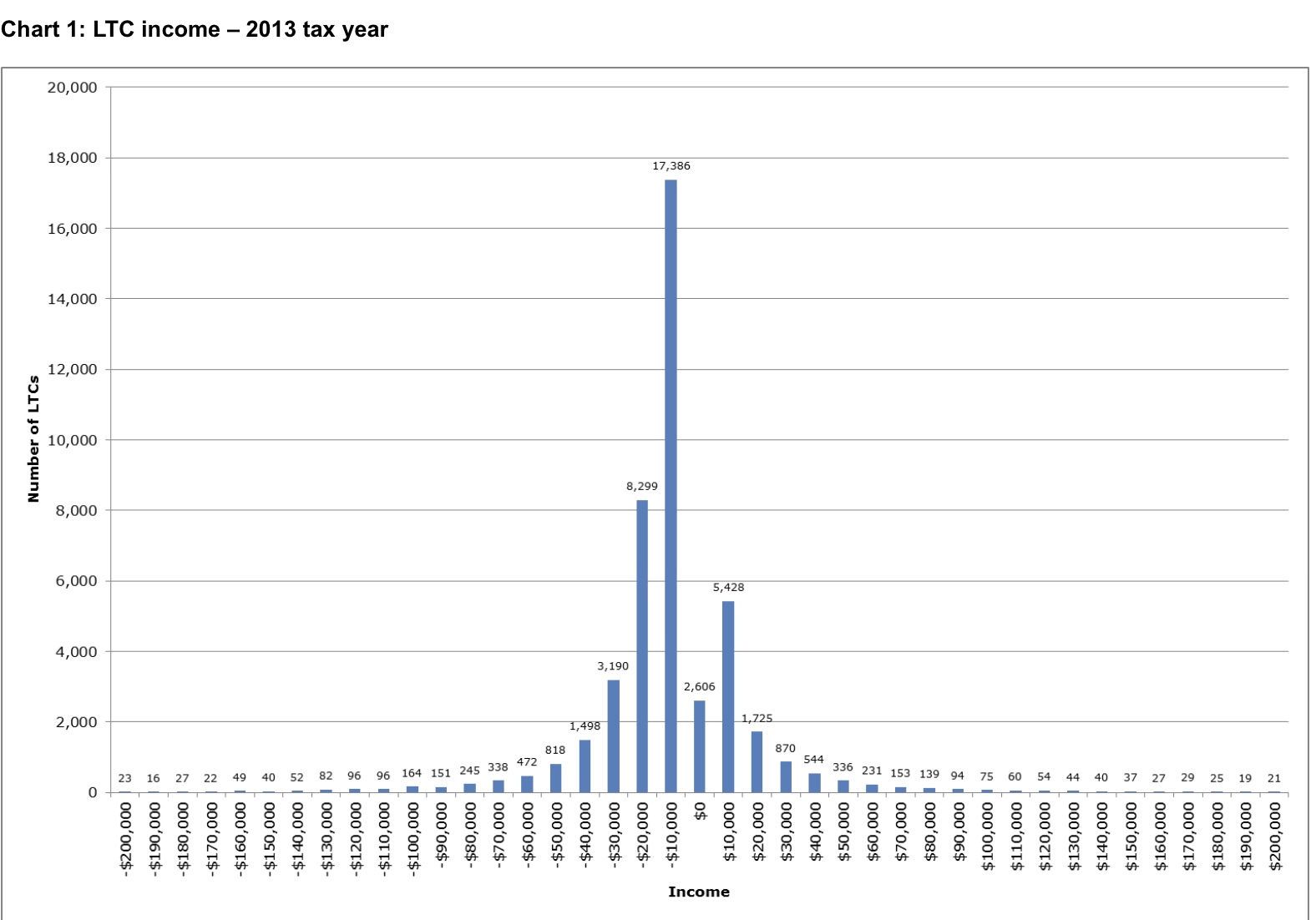

It is true that we have a similar vehicle here in the look through company. But unsurprisingly, under imputation, this is used primarily for taxable incomes of under $10k. It is quite compliance heavy and does require tax to be paid by the shareholder while it is the company that has the underlying income and cash. But it is elective and seems to be predominantly currently used as a means of accessing corporate losses.

But back to tax fairness and company taxation.

The argument put to me by my friends – with more practical experience than I have – was: if you want to increase the level of taxation paid by the people with wealth – increase the company tax rate as that is the tax rich people pay. The logical tax rate would be the trust and top personal rate – currently 33%.

That company tax is the tax rich people pay is absolutely true. The 2016 IR work on the HWI population shows exactly that:

It would also mean that the rules that other countries have like personal services companies or accumulated earnings – that we absolutely need with a mismatch in rates – no longer become necessary.

But what about foreign investment through companies?

If the focus was New Zealanders owning closely held New Zealand businesses, an adjustment could be made either by increasing the thin capitalisation debt percentage or making a portion – most likely 5/33 – of the imputation credit refundable on distribution.

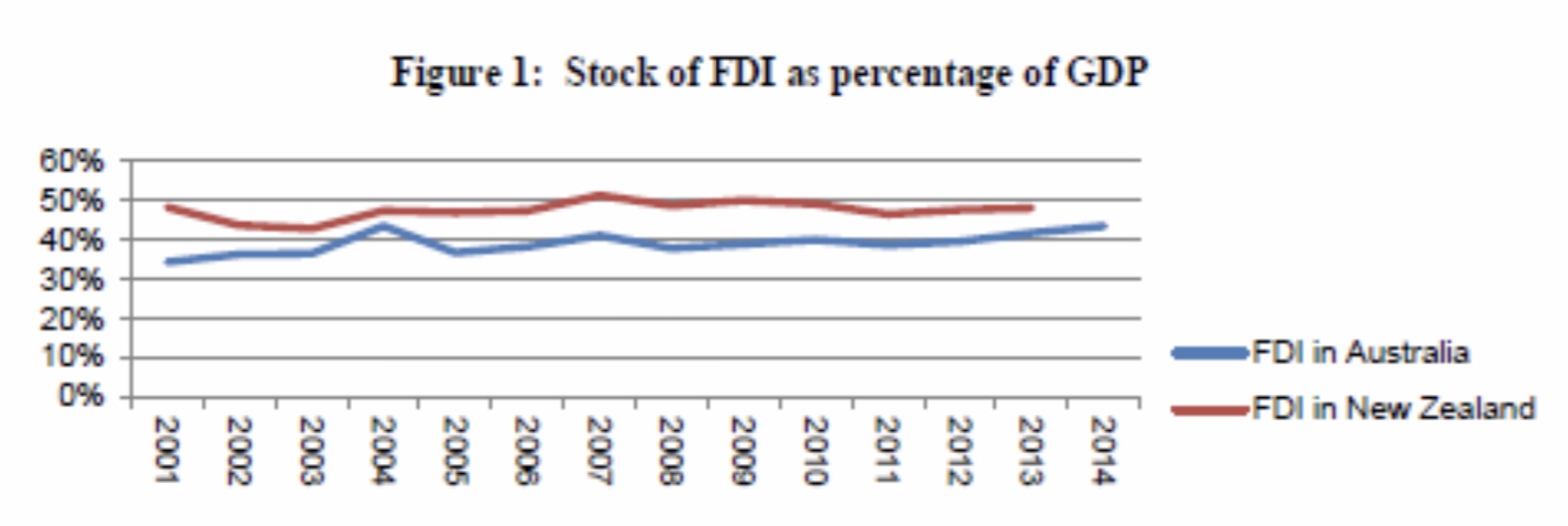

However there is also an argument not to do this. The relatively recent cut in the company tax rate has not particularly affected the level of foreign investment in New Zealand. (2)

Personally I am agnostic.

Listed companies?

Based on officials advice to the TWG (3) this group fully distributes its taxable income. So if the company tax rate increased all this would mean was that resident shareholders received a full imputation credit at 33% rather than one at 28% and withholding tax at 5%.

What happened to non-resident shareholders would depend on the decision above on non-resident investors. Either they would pay more tax on income from NZ listed companies or there could be a partially refundable imputation credit to get back to 28c.

The top PIR rate for PIEs could now also be increased to the top marginal tax rate for individuals as I keep being told the 28c rate is not a concession – more to align it with the unit trust or company tax rate. Or maybe KiwiSavers stay at 28% alongside an equivalent reduction for lower rates.

Start ups already have access to the look through company rules and so some more may access those rules if the shareholders marginal rates were below an increased company tax rate.

So an increase in the company tax rate need not have a material impact on foreign investment, listed companies and start ups.

Which then brings us to profitable closely held companies. Ones where the directors have an economic ownership of the company. A lower tax rate should, on the face of it, have allowed retained earnings and capital to grow faster. And therefore allow greater investment.

And on the face of it that is what has seemed to happen with this group. Imputation credit balances have climbed since the 28% tax rate meaning that tax paid income has not been distributed to shareholders.

However loans from such companies to their shareholders have also climbed indicating that value is still being passed on to shareholders – just not in taxable dividend form.

Now yes shareholders should be paying non-deductible – to them – interest to the company for these loans but it is more than coincidental that this increase should happen when there is a gap between the company rate and that of the trust and top personal tax rate.

And alongside this was an increase in dividend stripping as a means of clearing such loans.

So an increase in the company tax rate would reduce those avoidance opportunities and align the tax paid by incorporated and unincorporated businesses.

And with more tax collected from this sector, Business would have a strong argument for more tax spending on the things they care about. Things like tax deductions in some form for seismic strengthening, setting up a Tax Advocate, or the laundry list of business friendly initiatives that get trotted out such as removing rwt on interest paid within closely held groups.

Some of which might even be productivity enhancing.

For the next few months, I am returning to gainful – albeit non-tax – employment. As it is non-tax there should be no conflicts with this blog except for my energy and – possibly – inclination.

I am hopeful that at least two guest posts will land over this period and you may still get me in some form.

But otherwise I will be maintaining the blog’s Facebook page, and am on Twitter @andreataxyoga. I can also recommend Terry Baucher’s podcasts – the Friday Terry – when he isn’t swanning around the Northern Hemisphere.

Andrea

(1) Officials wrote a very good paper for the TWG on company tax rate issues. It can be found here: https://taxworkinggroup.govt.nz/sites/default/files/2018-09/twg-bg-appendix-2–company-tax-rate-issues.pd

(2) Paragraph 33 for a discussion of this graphs limitations. These include a reduction in the amount of deductible debt and depreciation allowances at the time of the reduction to 28% which would have worked in the opposite direction to the tax cut.

(3) Paragraph 11

Where have all the audits gone?

Blogging this time around is quite a different experience to last time. Then I was still relatively unknown and didn’t have the wide circle of cool progressive friends that I do now.

I tried out various types of subjects and – much like now – went broadly where my interest and the topics of the day were trending. The post that got me noticed was the review of TOP’s tax policy – including getting noticed by Gareth Morgan and the one that went the widest was my push for Deborah Russell.

The one that got most hits on the day – and it is still the number one – was when I got upset about the Inland Revenue restructure of the investigation function. My friends were hurting and so I was hurting too.

Since then my LinkedIn feed has shown a steady stream of talented people leaving Inland Revenue for other opportunities. I have heard it said that the people who left were change resistant and/or deadwood. The fact that they left would put lie to the change resistant angle. And given they have all moved on to senior positions in government, the Big 4, international organisations or their own successful practices – I think deadwood is a stretch too.

The Commissioner recently told the Finance and Expenditure committee that there had been no drop in technical expertise (1). And I think that is probably right. While there has been a net loss of talent, there are still lots of very capable competent people there. A number of people who were senior team leaders have gone back to doing the work. They were kick arse before they became team leaders and will be kick arse now. The tax system is safe with them.

Similarly the managers who were ultimately appointed. All very sane, experienced and competent. Yes some took redundancy but they are now doing different cool things with their lives.

So for these reasons I haven’t felt any need to reopen this topic. My friends who were affected have now either moved on and happy in their new roles or accepted the pay cut – after equalisation wears off – given the other benefits working for the Revenue entails. And there are quite a number. Flexibility, intellectual interest, and socially productive work – to name but three.

Yes there is still the matter of a 27% engagement score (2) but that is between the Commissioner, the Minister and the State Services Commissioner. Nothing I can add to that. There should still be the capability and capacity to run a decent audit programme even after the restructure.

Like most of the tax community, I had heard that this year people were being moved out of investigating into correspondence or the phones to help the BT transition. But they were only mumurings – there was no proof of that.

Until now.

Andrew Bayly Opposition spokesman for Revenue has put in a number of written parliamentary questions – it appears – looking to get to the bottom of the mumurings.

He asked quite a number of questions but the one I homed in on was audit hours. (3) Dear readers they have plumeted. June 19 is a third of June 18 – yes a third. To be fair that is probably the worst month. At best they are 2/3 of the previous year.

So the murmurings were true.

Ok so during an important stage the Commissioner moved her resources around. Fair enough.

What I don’t understand is if they were to fall like that why not come clean? Front foot it to the tax community. Say yeah audit activity will drop over this period because [insert reasons here] but – much like Arnie – we’ll be back baby. Don’t get complacent.

But it does mean that if this level of resources are being shifted from BAU to BT, BT is costing more than originally forecast. And these extra costs should be booked against BT. Or if they are being booked against BT – then the BAU money should be given back. It’s not like the Government doesn’t have uses for it.

Now none of this, as far as I can tell, is being mentioned in the monthly reporting to Joint ministers. This focus is solely on the BT programme and no mention, that I can see, on the affect on BAU.

There is, however, a mention in the paper Minister Nash took to Cabinet in November

The department’s service performance may dip while these changes are embedded. I will be kept regularly informed of any issues that arise. (4)

So I can only assume there has been parallel reporting on BAU to the Minister of Revenue on this and he and Treasury are happy with the reallocation of resources.

Of course if I have any of this wrong Inland Revenue – as I know you read the blog – please let me know and I’ll retract accordingly. But otherwise – Andrew Bayly is doing his job.

Andrew, our politics may not be the same, but dude – respect. I now have your wpq link on speed dial. Thank you for your service.

Andrea

(1) Second paragraph page 4

(2) Page 12 question from Dan Bidois

(3) The answer to audit commencements about not having information that predates START is odd. We all used to put our time into eCase. Clumsy and annoying. But it was all there. I can’t believe that Inland Revenue would be in breach of the Public Records Act and not have that information anymore. Would be a really back look too given taxpayers have to hold records for 7 years. Must be a mistake.

(4) Paragraph 32

Tax and Small Business

Last week the Small Business Council issued its report to Government. I am sure there are many wizard things in there maybe even some tax recs.

Also last week I had a friend to stay who is helping some workers that have lost thousands of dollars of wages and holiday pay when their employer went into receivership. Her expression was Wage Theft. It is a crime in Australia but not in New Zealand. Unlike theft as a servant which totally is.

Talking to her it was obvious that there was considerable overlap between what she is seeing and the issues considered by the TWG of closely held companies where the directors have an ownership interest not paying PAYE and GST (1).

And yes my friend’s friends are worried about their PAYE and KiwiSaver deductions. So really hope tightening up on this stuff is in the Small Business report along with the expected recs on compliance cost reduction.

I am also personally very interested in what the Group comes up with as the Productivity Commission noted that NZ has a lot of small low productivity firms without an up or out dynamic (2). That is firms tieing up capital that should be released for more productive purposes with the associated benefit of not staying on too long and dragging their workers and the tax base with them.

Now ever since I found that reference I have been concerned that there may be aspects of the tax system that may be driving that. Benefits or ‘opportunities’ that don’t arise for employees subject to PAYE or owners of widely held businesses subject to audits and outside shareholder scrutiny.

And it is true that there is nothing particularly special in a tax sense here to New Zealand. However given that New Zealand rates as number one in the ease of doing business index there may be more people going into business than would be the case in other countries.

Some of these aspects can be reduced through stricter enforcement by Inland Revenue but are otherwise largely structural in a self assessment tax system where the department doesn’t audit every taxpayer. One is a policy choice possibly because the alternative would add significant complexity to the tax system and the final example is a combination of the need for stronger enforcement and/or policy changes needed now that the company and top personal rate are destined to be permanently misaligned.

So what are these ‘aspects’?

Concealing income or deducting private expenses

Recent work by Norman Gemmell and Ana Cabal found that the self employed had 20% higher consumption than the PAYE employed at the same levels of taxable income.

Now it could be that for some reason the extra consumption of the self employed comes from inheritances or untaxed capital gains or taking loans from their business – more on that later – more so than those in the PAYE system or owners of widely held businesses. It might not be tax evasion at all.

But we just don’t know.

All we know is the 20% extra consumption and that there is a greater opportunity and fewer checks with closely held businesses to conceal income or deduct personal expenses. And Inland Revenue says such levels are comparable with other countries.

While things like greater withholding taxes and/or reporting can help, I am also concerned that with greater automation it also becomes much easier to have those personal expenses effortlessly charged against the business rather than recorded as personal drawings.

Interest Deductions

The second aspect is my specialist subject of interest deductions. Unlike concealing income or deducting personal expenditure – this one is totes legit.

Interest is fully deductible to a company and for everyone else it is deductible if it can be linked to a taxable income earning purpose or income stream aka tracing.

What that means is if a business person has a house of $2 million and a business of $1 million and has debt of $1 million – all the interest deductions on the debt can be tax deductible – if the debt can be linked to the business. This can be compared to a house of $2 million and debt of $1 million – and no business – where none of it is deductible.

To make this fairer with taxpayers who don’t have the opportunity to structure their debt there would need to be some form of apportionment over all assets – business and personal. So in the above example interest on only $330,000 should be allowed.

But yes – that would require a form of valuation of personal and business assets. And yes valuing goodwill brings up all the same – valid – concerns raised with taxing more capital gains.

So I guess we can say that under the status quo fairness – and possibly capital allocation – have been traded off against compliance costs.

Income Splitting

The third is the ability to income split with partners to take advantage of the progressive tax scale. Now this is only actually allowed if the partner is doing work for the business. But verifying the scale and degree of this work – even with burden of proof on Commissioner – is a big if not impossible task for the Commissioner.

Other mechanisms include loans from the partner to help max out the lower income tax bands.

And the statistics would support an argument that there is a degree of maxing out the lower bands just not that there necessarily is a lot of income splitting.

Interestingly both Canada and Australia have rules for personal services companies where these types of deductions are not allowed.

But this is ok if this is the amount of value going to the shareholders. Maybe our firms are so unproductive that they can only support shareholder salaries of $70k and below.

If that were the case though we wouldn’t be seeing the final aspect which is taking loans from companies you control instead of taxable dividends.

Overdrawn shareholder current accounts

Now to be fair for this to occur there should also be interest paid by the shareholder to the company on loans from the company to the shareholder. And unlike the interest in point 2 – none of this should be tax deductible to shareholder if it is funding personal expenditure while the interest received will be taxable. This on its own should be enough to not do it and receive taxable dividends instead.

Unfortunately the facts also don’t seem to back this up. Imputation credit account balances – meaning tax has been paid but not distributed- have been climbing. Now this could be like totally awesome if it meant all the money was being retained in the company to grow.

Except that overdrawn current account balances – loans from the company to the shareholders- have been similarly growing too. Now sitting at about $25 billion.

And yes this all started from about 2010. And what happened in 2010? Why dear readers the company tax rate was cut to 28% while the trust rate remained at 33%.

Ironically the associated cut in top marginal rate was to stop the income shifting that went on between personal income and the trust rate.

Now one level it shouldn’t matter at all if these balances continue to climb so long as non- deductible assessable interest is paid on the debt. However an overdrawn current account is – imho – the gateway drug to dividend avoidance.

And yes that can be tax avoidance but much like the tax evasion opportunities, income splitting and interest on overdrawn current accounts – all of this requires enforcement by Inland Revenue. And as they can’t audit everyone there will always be a degree that is structural in a self assessment tax system.

But the underlying driver of people wanting to take loans from their company rather than imputed dividends is that our top personal tax rate and company tax rate are not the same. Paying a dividend would require another 5% tax to be paid.

Possible options

Now other countries have always had a gap between the top rate and either the company or trust rate so this shouldn’t be the end of the world. But those countries have buttressing rules that we don’t have in New Zealand. The personal services company rules discussed above or the accumulated earnings tax in the US (3) or the Australian rule that deems such loans to be dividends.

Until recently I had been a fan of making the look through company rules compulsory for any company that was currently eligible. (4) I couldn’t see the downside. The closely held business really is an extension of its shareholder so why not stop pretending and tax them correctly.

However some very kind friends have been in my ear and pointed out the difficulties of taxing the shareholder when all the income and cash to pay the tax was in the company. It works ok when it is just losses being passed through. So maybe I am less bullish now.

An alternative approach could be to apply a weighted average of the shareholders tax rates on the basis that all the income would be distributed. Similar to PIEs. The tax liability is with the entity but the rate is based on the shareholders. I guess you then do a mock distribution to the shareholders which can then be distributed to them tax free. And yes only to closely held companies. Wider would be a nightmare.

Kind of a PIE meets LTC.

Or you could just old school it and raise the company tax rate to 33% for all companies. Shareholders with tax rates below that could use the LTC rules and make the assessment of whether the compliance of the rules was greater or less than the extra tax.

It would require an adjustment to the thin capitalisation rules by increasing the deductible debt levels to ensure foreign investment didn’t pay more tax. But for some of you dear readers increased taxation on foreign investment might even be a plus.

But all in all I don’t think the status quo with small business is a goer. Whether it is for fairness reasons, or capital allocation reasons or simply stopping me worrying – doing something is a really good idea.

Because I would hate to think any of this was enabling behaviours that kept people in business longer than they should. And even with the most whizziest of new IRD computers – there will always be limits on enforcement.

Andrea

(1) Page 116 Paragraph 68

(2) Page 19

(3) Although it would make more sense to only apply this to the extend that the income hasn’t been retained in the business and distributed in non- dividend form.

(4) Yes there is the issue that companies could start adding an extra class of share to get around this. But I don’t believe this is insurmountable with de minimis levels of additional categories and the odd antiavoidance rule for good measure. It is even the advice of KPMG so clearly not that wacky.

Source country taxation, the environment and oil rigs

Last week sometime I found myself in a Twitter discussion with PEPANZ – of all people – as they were saying the TWG had supported the recent extension of the tax exemption for oil rigs. It is an exemption that is theoretically timelimited for non-resident companies involved in exploration and development activities in an offshore permit area. Theoretically because it will have been in force for 20 years if it actually does expire this time.

Having been a little involved with the TWG – as well as the Treasury official on the last rollover – I was somewhat surprised by PEPANZ’s comment. But in the end they were referring to an Officials paper for the TWG rather than a TWG paper per se. A subtle and easily missed difference.

And one they unfortunately also made in their submission to the Finance and Expenditure Committee (1). Although it was a little odd that they needed to make a submission as everyone has known for 5 years that the exemption was expiring.

But in that thread PEPANZ encouraged people to read the Cabinet paper and so for old time sake I did. The analysis was quite familiar to me but the thing that gave me pause was the fiscal consequences were said to be positive.

Yes positive.

Implementing a tax exemption would increase the tax take. A veritable tax unicorn.

No wonder it had such support. I guess this exemption will now have to come off the tax expenditure statement.

Personally I am not a fan of this exemption or its extension. And although I accept the prevailing arguments – much like the difference between a paper for the TWG and a paper of the TWG – it is less clear cut than it seems.

International framework for taxing income from natural resources

Now followers of the digital tax debate will know all about how source countries can tax profits earned in their country if these profits are earned through a physical presence in their country aka permanent establishment. And because it is super easy to earn profits from digital services without a permanent establishment there is a problem.

However for land or natural resource based industries a physical presence is – by definition – super easy.

And if you properly read treaties there is a really strong vibe through the individual articles that source countries keep all profits from its physical environment (2) while returns from intellectual property belong to the residence or investor country.

So before tax fairness or stopping multinational tax evasion was a thing, there was source country taxing rights based on natural resources.

Then to make it super super clear Article 5(2)(f) of the model treaty makes a well or a mine a permanent establishment just in case there was any argument.

To be fair to our friends the visiting oil rigs, other than the physical environment vibe there is no actual mention of exploration in the model article. But the commentary says it is up to individual countries how they wish to handle this. (3)

What does New Zealand do?

The best one to look at is the US treaty. In that exploration is specifically included as creating a permanent establishment but periods of up to 6 months are also specifically excluded (4).

This is interesting for two reasons.

First the negotiators of the treaty clearly specifically wanted exploration to create a taxing right as this paragraph is not in the model treaty. Secondly it stayed in the treaty even after a protocol was negotiated in 2010. That is if this provision and the 6 month carve out were a ‘bad’ thing for New Zealand it would have made sense for it to have come out at that point. Either unilaterally or as a tradeoff for something else.

So in other words anything to do with the taxation of oil rigs involved in exploration cannot be considered to be a glitch with the treaty that could be fixed with renegotiation. Unless of course it was oversight in the 2010 negotiations.

What are the facts?

The optimal commercial period for these rigs to be in New Zealand seems to be about 8 months. That is two months or so too long to access the exemption. But rather than pay tax they will leave and another rig will come in with associated extra costs and environmental damage.

This is what was happening before the exemption came into place in 2004 and so does prima facie seem a reasonable case for just having an outright exemption. However:

The 2019 Regulatory Impact Statement says that the contracts have a tax indemnity clause meaning that any tax payable by the non-resident company must be paid by the New Zealand permit holder. (5)

This means that the outcomes would be broadly similar to this table. This is on the basis that rigs could be substituted albeit with delay at additional cost rather than exploration simply being deferred to another year. (6)

Why don’t I like the exemption?

Much like the difference between TWG reports and reports for the TWG it is all pretty nuanced.

Pre 2004, as there were tax indemnities, the only reason to have the rigs leave and another one come in was if the cost to the company of the churning was less than the cost – paying the tax – of the rig staying put.

However while that would be a completely reasonable business decision for the company it is highest cost for the country as a whole and the highest cost to the tax base of all the options.

And so the argument for an exemption was framed. An exemption lowers the cost to the Crown and also to the company. Win Win.

However the tax base does best in a world without the exemption but where the rigs stay put and the company pays the non-resident operators tax.

Now requiring that would be somewhat stalinist but it does feel that Government has had its hand forced when it wasn’t party to any of the original decisions. The Government has no control over the cost structure of the industry but:

- Needs to exempt income of a class of non-resident at a time when it is looking to expand taxing rights over other non-residents;

- Weakens its claim on the tax base associated with natural resources,

- Gets offside with a major stakeholder of its confidence and supply partner.

And all of this is before you get to the precedential risk associated with moving away from the otherwise broad base low rate framework. Which by definition involves winners and losers.

I am also not convinced by the revenue positive argument. The RIS states that as the exemption has been going on forever the forecasts have already factored in the exemption (7). This means an extension of the exemption has no fiscal effect.

However by the time it gets to the Cabinet Paper – albeit close to a year after the RIS was signed off – a $4 million cost of not extending the exemption has now been incorporated into the forecasts (8). And so – hey presto by extending the exemption – an equivalent revenue benefit arises that can go on the scorecard (9). From which other revenue negative tax policy changes can be funded.

Every Minister of Revenue’s dream.

So like I said – not a fan. There is a narrow supporting argument. Absolutely. But the whole thing makes me very uncomfortable. To make matters worse – it is only extended for 5 years. It hasn’t been made permanent. Even after 20 years. SMH.

Hope I am doing something else in 5 years time.

Andrea

(1) Curiously officials write up of the submission in the Departmental report page 171 is far more fulsome than the written submission. I guess it must reflect an empassioned verbal submission from PEPANZ.

(2) Article 6 of the model treaty makes this explicit without any reference to a permanent establishment.

(3) Paragraph 48 Page 128

(4) Article 5(4)

(5) Paragraph 6. This comment isn’t the the recent RIS but as the analysis is based around the New Zealand permit holder wearing the additional costs associated changing the non-resident operator it is reasonable to assume that equivalent clauses are in the new contracts.

(6) Section 2.3 of RIS discusses the delays associated with changing operators.

(7) Page 11

(8) Paragraphs 21-23

(9) Section 4.6

Fringe Benefit Tax – Reply from Inland Revenue

There is nothing much more humbling than motherhood. No matter how competent you are in your day job, one’s darling offspring have the ability to test every part of you.

For that reason I have rarely met arrogant mothers. Sure most of us have views about the right way of handling things but that is really a function of values and how your particular child works.

Because children’s superpower is their ability to ensure that we are only ever one meal or one exam or one party away from fully questioning our ability to raise the next generation.

Tax is much like that too. Tax people can be confident but we all know that we are only ever one opinion – missing a section or a case – away from falling completely on our faces.

And so it is for me on my recent post on Fringe Benefit Tax and double cab utes. Inland Revenue have kindly reached out to me to point out I overlooked a subsection – not the first time that has happened – and so office workers could not get the work related exemption if they had a sign written double cab ute.

I accept their analysis and accept that there is nothing in the law or its interpretation by Inland Revenue – as they have outlined it – that is driving the double cab ute phenomenon.

However it would be good to know how much FBT – or personal use adjustments – actually arises from personal use of the double cab utes. Because the ones I see aren’t even sign written.

Andrea

Reply from Inland Revenue

Hi Andrea

We have read your recent blog “Emissions, Feebates and Fringe Benefit Tax”(12 July 2019) and have a couple of comments regarding double cab utes and the work related vehicle exemption.

You have suggested that a sign-written double cab ute would be exempt from FBT under the work-related vehicle exemption. However, the work-related vehicle exemption is actually far narrower than that. Section CX 38 defines work-related vehicle:

CX 38 Meaning of work-related vehicle

Meaning

(1) Work-related vehicle, for an employer, means a motor vehicle that prominently and permanently displays on its exterior,—

(a) if the employer owns the vehicle, the form of identification that the employer regularly uses in carrying on their undertaking or activity; or

(b) if the employer rents the vehicle, the form of identification—

(i) that the employer regularly uses in carrying on their undertaking or activity; or

(ii) that the person from whom it is rented regularly uses in carrying on their undertaking or activity.

Exclusion: car

(2) Subsection (1) does not apply to a car.

Exclusion: private use

(3) A motor vehicle is not a work-related vehicle on any day on which the vehicle is available for the employee’s private use, except for private use that is— (a) travel to and from their home that is necessary in, and a condition of, their employment; or (b) other travel in the course of their employment during which the travel arises incidentally to the business use.

Paragraph (3) of s CX 28 is often overlooked. It states that if the vehicle is available for private use (other than for travel from home to work or incidental travel) then it is not a work-related vehicle and it will be subject to FBT. The exemption is actually quite narrow.

Inland Revenue interprets s CX 28(3)(a) to mean an employee cannot use a vehicle for private use except for travel to and from their home where that travel has a direct or needed relationship with the employee’s employment; and is a requirement of that employee’s terms of employment. So in your scenario, the shareholder-employee that runs the office would not be entitled to the work-related vehicle exemption. We make this point explicitly at para [107] of Interpretation Statement IS 17/07 “FBT and Motor Vehicles”:

For example, if a receptionist is given a vehicle to travel between home and work, the employer would not be entitled to the benefit of the private use exclusion in s CX 38(3)(a), because the travel to and from home is not necessary to the receptionist’s role.

We have tried to clarify this aspect of the work-related vehicle exemption for taxpayers and their advisors. Our Interpretation Statement IS 17/07 “FBT and Motor Vehicles” https://www.classic.ird.govt.nz/technical-tax/interpretations/2017/ explains the exemption in detail from para [66] onwards. We have also made a video on the work-related vehicle exemption: https://www.classic.ird.govt.nz/help/demo/fbt-videos/

Hope this helps and happy to discuss this with you if you’d like.

Kind regards

SUPERCommissioner

OVER 2,000 hack attempts and I finally broke into Andrea’s blog. (1) I should have known straight away her password would be CGT4eva. So here I am. Another rare left-leaning socially progressive tax expert.

This may be why Michael Wood, chair of the Finance and Expenditure Select Committee – politely and somewhat bemusedly – said to me: “you realise you are the only submission against this aspect of the bill….this should be interesting”.

The bill is now an Act of Parliament, the Taxation (Annual Rates for 2019–20, GST Offshore Supplier Registration, and Remedial Matters) Act 2019.

I was not the only submitter on the bill.

There were 268 submitters who opposed the ring-fencing of rental losses. Of course there were – some people might have to pay more tax. But, only one submitter (me), was opposing a tiny amendment that was also a blatant disregard for democracy and the rule of law.

And that tiny amendment created the Commissioner’s new superpower.

While Spiderman has quite an extraordinary power to climb, and Magneto has the power to control magnetic fields, much more useful than all that, the Commissioner of Inland Revenue has acquired the power to exempt taxpayers from tax law.

Totally wicked.

This power can be used to make a wide-reaching exemption for all taxpayers affected by the law, or limited to specific circumstances. You know – just special people.

The Commissioner may use her power to correct ‘obvious errors’ in the law. Or to give effect to the law’s intended purpose – as determined by the Commissioner – to resolve an ambiguity in the law, to reconcile inconsistencies between two laws or between the law and an ‘administrative practice’.

The last one is my personal favourite.

The Commissioner may grant the exemption where a tax law is inconsistent with the IRD practice on the issue. Wonderful. So unelected bureaucrats trump Parliament? Although yeah I get that Parliament has given the Commissioner this power. And this quite extrordinary superpower has been granted with little public interest.

There are two reasons for this.

First tax is apparently boring and doesn’t attract great public interest unless one’s own wallet is impacted. The usual submitters (tax geeks) generally represent business interests. The other reason is that the power is likely to operate only in a taxpayer’s interest, not against.

The provisions state that a taxpayer is not required to follow the Commissioner’s edict to exempt a law. Aha not so powerful after all. Taxpayers can choose to follow the strict letter of the law. In other words, this exemption will only be applied for the benefit of the taxpayer, not to their detriment.

So what’s my problem? My concerns are two-fold.

First, I am not comfortable with administrative functions being granted superpowers to circumvent law made by the democratically elected representatives. Second, I am concerned with who will benefit from these provisions.

Segregation of the duties of our government is one of the foundations of New Zealand’s (unwritten) constitution. Law making power is granted to the elected body – parliament – made up of members chosen by the people and crossing all spectrums of society.

Administration of the law is taken up by unelected employees of government. Granting law making (or breaking) powers to an official appointed by the State Services Commissioner crosses the segregation boundaries and undermines the process of law making.

Granting the Commissioner the ability to exempt a law because it is inconsistent with an administrative practice moves into the sphere of law making.

The third branch of government, sitting alongside parliament and the executive, is the judiciary – those who interpret and enforce law.

Granting the Commissioner the power to exempt taxpayers from a law because it is inconsistent with parliament’s intention steps on the toes of the judiciary. It is the judiciary’s role to determine what the intention of parliament might be.

My second concern is somewhat more pragmatic. Who is this superpower designed to benefit?

Most New Zealanders receive all their income from salary and wages and pay their tax through the PAYE system. Most New Zealanders have no need for an accountant and do not even file tax returns.

But if you have more complex financial affairs, you may need an accountant. And if you have lots of money, you might have a very expensive accountant with a great deal of expertise in money matters – including tax. You might have a very expensive lawyer as well. This is good news and has kept me in gainful employment through my working years.

Now, I have spoken with a few of my friends (who have accountants but not the expensive sort), and they tell me they are not aware of the Commissioner’s new superpower. They tell me they are unlikely to be requesting the Commissioner to use her new power in their favour due to – well – ignorance. I have an inkling who may be inclined to use the new provisions, however.

Perhaps those with more complex tax affairs. Perhaps those who use expensive accountants and lawyers. Perhaps those with access to tax knowledge and expertise.

Now the Inland Revenue officials who have reviewed my submission have said, “don’t worry” Alison. The Commissioner’s new superpower is “intended to only be used for minor or administrative matter where there are no, or negligible fiscal implications”. Which would be fine except that’s not what the legislation says.

The superpower is not at all limited to ‘minor or administrative’ matters. It is far broader than that. And as for ‘no or negligible fiscal impact’… what would be the point of exempting a law if there was no or negligible fiscal implications?

And once again, this is not exactly what the law says. It says the Commissioner may only use her power if there are no or negligible fiscal implications for the Crown. Now the last financial year produced over $80bn of tax revenue for the Crown. So I ask, what is negligible in the context of $80bn? Is $20m negligible?

This is up to the Commissioner to determine.

Now I do not mean to suggest any corruption on the part of our tax administration or our current Commissioner. But the law must protect the people from the potential for corruption. And this law steps well over that line.

The use of this superpower will be one to watch. But who will be watching? That is a conversation for another day.

Alison

————————————————————————————————————

(1) I note though that Andrea prefers ‘unauthorised access’ to ‘hack’. But as she invited me in – albeit not through a search bar – she can get over herself.

Guest Writing

Hello lovely readers.

After almost three years of this blog being a solo gig I am now trying something a bit different.

Following the example of Mick Jagger and why he performs with super talented back up singers:

‘Otherwise it would be a bit boring – it would just be me, me, me and a bit of Keith’. (1)

I have decided to open the blog up to guest writing. Well one writer at the moment. I have approached another but she hasn’t got back to me. You know who you are!

As of tomorrow Guest Writer number 1 is Alison Pavlovich. Alison teaches tax at Massey as did the OG of progressive tax thought Deborah Russell. Alison used to be important in the UK and now – for reasons that are beyond me – is doing a PhD.

More importantly she is cool, has views and agreed to a cameo appearance. So – dear readers – give her lots of clicks to make her feel loved and maybe she’ll come back.

If these tentative steps prove successful, I’d like to open the blog up more widely to viewpoints and authors that wouldn’t normally be heard. An ability to write and not take it all too seriously will be key. I would also be open to anonymous or pseudonym writing in particular cases. Tax knowledge is a given.

Yes that is all code – work with it.

As for me – I’ll still be here – doing my thing as often as I have to date. But now – I hope – you also get to hear other voices.

Hope you enjoy it.

Andrea

(1) This comes from one of my truly favourite films in the whole entire world 20 Feet from Stardom. It is on Netflix. Team watch it now!

Emissions, Feebates and Fringe Benefit Tax

This week the Government released a discussion document on a form of emissions pricing for new and imported vehicles. Pretty much on cue the opponents were railing against this ‘tax’ thereby bringing it into scope for this blog.(1)

[The reason for the badly drawn boxes will become clear in a bit. I can assure the Leader of the Opposition that they have nothing to do with poor graphic design on the part of the National Party Research Unit.]

The idea is that heavy emitting vehicles would pay a charge and low emitting vehicles would get a subsidy. While they were aimed to broadly net off there is likely to be a net cost which the Government will need to appropriate as a reserve fund to keep it all moving (2).

As an aside my former tax policy self can’t help feeling what is proposed in the discussion document is all a bit technically perfect and could possibly be simplified without losing too many of the behavioural benefits. (3)

But implicit in all of this is that there is some sort of market failure or unpriced externality as New Zealanders, more than other countries, seemed to value a low capital cost highly even if it involved higher running costs.

I guess then in a ‘if you can’t beat them join them approach’ the deal is that the government will marginally bring down the capital cost of low emitting, low running cost vehicles. Giving net benefits of between $111 and $821 million being largely a reduction in fuel costs from people driving more fuel efficient cars.

I haven’t fully nailed this yet as conceptually on an npv basis if low emitting cars have lower running costs the net benefits should stand on their own without government intervention. So I am wondering if there is something in a lack of personal savings to fund the higher capital cost or a bias against potential loss of value v operating costs that is influencing these decisions. (4)

Regardless it seems to be a microcosm of the environmental tax proposals in the Tax Working Group. There the proposals were that any money raised from additional taxation was used to fund the transition to greater environmental sustainability. (5)

As here it was a bit loose. Revenue recycling was the term used rather than hypothecation as it gave the Government the ability to also put money into any transition programme and so not be constrained by the funds actually raised.

And much like most of the environmental proposals in the TWG report – behavioural benefits are the name of the game. Rather than revenue raising.

And much like all behavioural taxation and subsidies – whether they have any actual effect will depend on the elasticity of demand for such vehicles (6). Because if demand is:

- Very elastic – price sensitive – the $8000 benefit v $3000 cost will see a massive swing away from high emitting to low emitting vehicles. There will be no revenue raised and it will cost the Government a packet.

- Elastic ish – it will have an effect but there will still be high emitting cars purchased. This is useful if the Government wants minimise it’s contribution to the overall cost.

- Inelastic – price insensitive – there will be little or no change as people love their big emitting cars. On that basis it would start to become more like tobacco excise and become a good little earner for the Government. For the planet – not so much.

Now in the cabinet paper there is a list of other complementary things the government is doing (7). But curiously there is nothing on tax other than the RIS correctly ruling out a GST exemption for electric cars. Maybe it was because the Ministry didn’t consult with Inland Revenue (8) as I would have hoped the Department could have explained to them how environmentally unneutral fringe benefit tax (FBT) is.

Fringe benefit tax and the environment

The deal with fringe benefit tax is it taxes fringe benefits – such as ‘free’ cars or cheap loans – given to employees. The idea is that then there will be a tax level playing field to receiving cash wages and non-cash fringe benefits such as cars. FBT is an OG promoter of tax fairness as non-cash benefits are more likely to be given to higher income people.

However for completely unintentional reasons, in two ways, this tax could be incentivising the wrong things from an environmental perspective.

Carparks v public transport

The first is there is effectively no fringe benefit tax on the employer provision of car parks. This arises initially through an explicit exemption for any benefits provided on the employer’s premises.

The employer’s premises exemption make sense for compliance cost reasons as how do you work out the value of a benefit that is all part of the employer’s cost of running the business. So seems fair enough.

But when this meets car parks, the Department’s interpretation is that any leased land forms part of an employer’s premises.

And guess what – carparks are now all leased. Who would have thought!

There have been at least two attempts – one under Michael Cullen and another under Bill English – to legislatively remove this exemption. Both failed.

So rather than get on that horse again – as part of its environmental work – the TWG recommended that the government consider also removing FBT from the provision of public transport (9). To level the environmental – if not the tax – playing field.

Double cab utes and the work related vehicle

The second relates to double cab utes and the work related vehicle exclusion. See I told you my vandalising of the National Party’s work would become relevant.

[TL:DR The vandalised pictures would all meet definition of a work related vehicle – if signwritten – and be exempt from fringe benefit tax.]

A bit like the on premises exemption for car parks, there is also an exemption for work related vehicles. Again that makes sense for compliance cost reasons as there is not much private value from getting to take a work ute home.

In the late 80’s when I worked for a Chartered Accountant, the rules around work related vehicle were that it needed to be signwritten and it needed to have the back seats taken out of any vehicle that had more than two seats. I have very strong memories of the partner I worked for arguing with clients about how non negotiable both requirements were.

Now the rules seem to be that the vehicle is not ‘designed mainly to carry people’. (10)

I have been told that some time in the early 90’s the Department’s interpretation of this went from ‘take out the back seats’ to ‘double cab utes ok’.

Now for a sole operator tradie the need for the back seats may be a bit of a stretch as a requirement for a work related vehicle but is arguably ok. However I seriously struggle with a shareholder employee that runs the office and does the books having an FBT exempt dual cab ute. And yet that is exactly what is possible and completely legal.

All costs of the vehicle are tax deductible if the employer is a company and no FBT is payable.

So until there is a change to this I would suggest that the $3000 will simply be paid as it is less than the possible FBT that would otherwise be paid (11). In fact assuming no actual work related use or employee related expenditure any double cab ute that costs more than $31,000 it would make sense to just pay the $3,000. (12)

So may be this is revenue raising after all?

Andrea

Update (25/7/19)

Inland Revenue have kindly reached out to me to point out I overlooked a subsection – not the first time that has happened – and so office workers could not get the work related exemption if they had a sign written double cab ute.

I accept their analysis and accept that there is nothing in the law or its interpretation by Inland Revenue – as they have outlined it – that is driving the double cab ute phenomenon.

However it would be good to know how much FBT – or personal use adjustments – actually arises from personal use of the double cab utes. Because the ones I see aren’t even sign written.

(1) Long term readers will know this is nonsense as I will write on anything that spins my wheels.

(2) Paragraph 141 of Cabinet Paper.

(3) My former tax policy self also couldn’t help noticing options that looked awfully like tax pooling. The firms who offer that must currently be creaming it given the recent use of money interest rates. But that is a story for another day.

(4) Strictly speaking income tax also shouldn’t be a thing here as operating costs are tax deductible as is any interest expense and the capital cost is depreciable over time. It might conceptually be possible that the tax depreciation understates the actual depreciation but at 30% DV/21% straight line it doesn’t feel material or likely.

(5) Page 53 Paragraph 127

(6) Elasticity of supply will also feature in the final outcomes. If there is any form of constrained or monopolistic supply then the benefits could be absorbed by the supplier but with the costs passed on to consumer.

(7) Paragraph 35

(8) Paragraph 126

(9) Recommendation 18

(10) Section CX 38 of Income Tax Act 2007 and definition of car.

(11) 49.25% of 20% of cost price at say $45000 is FBT foregone of about $4.5k.

(12) Working backwards to a FBT cost of $3000, gives about $30,500.