Tax and Small Business

Last week the Small Business Council issued its report to Government. I am sure there are many wizard things in there maybe even some tax recs.

Also last week I had a friend to stay who is helping some workers that have lost thousands of dollars of wages and holiday pay when their employer went into receivership. Her expression was Wage Theft. It is a crime in Australia but not in New Zealand. Unlike theft as a servant which totally is.

Talking to her it was obvious that there was considerable overlap between what she is seeing and the issues considered by the TWG of closely held companies where the directors have an ownership interest not paying PAYE and GST (1).

And yes my friend’s friends are worried about their PAYE and KiwiSaver deductions. So really hope tightening up on this stuff is in the Small Business report along with the expected recs on compliance cost reduction.

I am also personally very interested in what the Group comes up with as the Productivity Commission noted that NZ has a lot of small low productivity firms without an up or out dynamic (2). That is firms tieing up capital that should be released for more productive purposes with the associated benefit of not staying on too long and dragging their workers and the tax base with them.

Now ever since I found that reference I have been concerned that there may be aspects of the tax system that may be driving that. Benefits or ‘opportunities’ that don’t arise for employees subject to PAYE or owners of widely held businesses subject to audits and outside shareholder scrutiny.

And it is true that there is nothing particularly special in a tax sense here to New Zealand. However given that New Zealand rates as number one in the ease of doing business index there may be more people going into business than would be the case in other countries.

Some of these aspects can be reduced through stricter enforcement by Inland Revenue but are otherwise largely structural in a self assessment tax system where the department doesn’t audit every taxpayer. One is a policy choice possibly because the alternative would add significant complexity to the tax system and the final example is a combination of the need for stronger enforcement and/or policy changes needed now that the company and top personal rate are destined to be permanently misaligned.

So what are these ‘aspects’?

Concealing income or deducting private expenses

Recent work by Norman Gemmell and Ana Cabal found that the self employed had 20% higher consumption than the PAYE employed at the same levels of taxable income.

Now it could be that for some reason the extra consumption of the self employed comes from inheritances or untaxed capital gains or taking loans from their business – more on that later – more so than those in the PAYE system or owners of widely held businesses. It might not be tax evasion at all.

But we just don’t know.

All we know is the 20% extra consumption and that there is a greater opportunity and fewer checks with closely held businesses to conceal income or deduct personal expenses. And Inland Revenue says such levels are comparable with other countries.

While things like greater withholding taxes and/or reporting can help, I am also concerned that with greater automation it also becomes much easier to have those personal expenses effortlessly charged against the business rather than recorded as personal drawings.

Interest Deductions

The second aspect is my specialist subject of interest deductions. Unlike concealing income or deducting personal expenditure – this one is totes legit.

Interest is fully deductible to a company and for everyone else it is deductible if it can be linked to a taxable income earning purpose or income stream aka tracing.

What that means is if a business person has a house of $2 million and a business of $1 million and has debt of $1 million – all the interest deductions on the debt can be tax deductible – if the debt can be linked to the business. This can be compared to a house of $2 million and debt of $1 million – and no business – where none of it is deductible.

To make this fairer with taxpayers who don’t have the opportunity to structure their debt there would need to be some form of apportionment over all assets – business and personal. So in the above example interest on only $330,000 should be allowed.

But yes – that would require a form of valuation of personal and business assets. And yes valuing goodwill brings up all the same – valid – concerns raised with taxing more capital gains.

So I guess we can say that under the status quo fairness – and possibly capital allocation – have been traded off against compliance costs.

Income Splitting

The third is the ability to income split with partners to take advantage of the progressive tax scale. Now this is only actually allowed if the partner is doing work for the business. But verifying the scale and degree of this work – even with burden of proof on Commissioner – is a big if not impossible task for the Commissioner.

Other mechanisms include loans from the partner to help max out the lower income tax bands.

And the statistics would support an argument that there is a degree of maxing out the lower bands just not that there necessarily is a lot of income splitting.

Interestingly both Canada and Australia have rules for personal services companies where these types of deductions are not allowed.

But this is ok if this is the amount of value going to the shareholders. Maybe our firms are so unproductive that they can only support shareholder salaries of $70k and below.

If that were the case though we wouldn’t be seeing the final aspect which is taking loans from companies you control instead of taxable dividends.

Overdrawn shareholder current accounts

Now to be fair for this to occur there should also be interest paid by the shareholder to the company on loans from the company to the shareholder. And unlike the interest in point 2 – none of this should be tax deductible to shareholder if it is funding personal expenditure while the interest received will be taxable. This on its own should be enough to not do it and receive taxable dividends instead.

Unfortunately the facts also don’t seem to back this up. Imputation credit account balances – meaning tax has been paid but not distributed- have been climbing. Now this could be like totally awesome if it meant all the money was being retained in the company to grow.

Except that overdrawn current account balances – loans from the company to the shareholders- have been similarly growing too. Now sitting at about $25 billion.

And yes this all started from about 2010. And what happened in 2010? Why dear readers the company tax rate was cut to 28% while the trust rate remained at 33%.

Ironically the associated cut in top marginal rate was to stop the income shifting that went on between personal income and the trust rate.

Now one level it shouldn’t matter at all if these balances continue to climb so long as non- deductible assessable interest is paid on the debt. However an overdrawn current account is – imho – the gateway drug to dividend avoidance.

And yes that can be tax avoidance but much like the tax evasion opportunities, income splitting and interest on overdrawn current accounts – all of this requires enforcement by Inland Revenue. And as they can’t audit everyone there will always be a degree that is structural in a self assessment tax system.

But the underlying driver of people wanting to take loans from their company rather than imputed dividends is that our top personal tax rate and company tax rate are not the same. Paying a dividend would require another 5% tax to be paid.

Possible options

Now other countries have always had a gap between the top rate and either the company or trust rate so this shouldn’t be the end of the world. But those countries have buttressing rules that we don’t have in New Zealand. The personal services company rules discussed above or the accumulated earnings tax in the US (3) or the Australian rule that deems such loans to be dividends.

Until recently I had been a fan of making the look through company rules compulsory for any company that was currently eligible. (4) I couldn’t see the downside. The closely held business really is an extension of its shareholder so why not stop pretending and tax them correctly.

However some very kind friends have been in my ear and pointed out the difficulties of taxing the shareholder when all the income and cash to pay the tax was in the company. It works ok when it is just losses being passed through. So maybe I am less bullish now.

An alternative approach could be to apply a weighted average of the shareholders tax rates on the basis that all the income would be distributed. Similar to PIEs. The tax liability is with the entity but the rate is based on the shareholders. I guess you then do a mock distribution to the shareholders which can then be distributed to them tax free. And yes only to closely held companies. Wider would be a nightmare.

Kind of a PIE meets LTC.

Or you could just old school it and raise the company tax rate to 33% for all companies. Shareholders with tax rates below that could use the LTC rules and make the assessment of whether the compliance of the rules was greater or less than the extra tax.

It would require an adjustment to the thin capitalisation rules by increasing the deductible debt levels to ensure foreign investment didn’t pay more tax. But for some of you dear readers increased taxation on foreign investment might even be a plus.

But all in all I don’t think the status quo with small business is a goer. Whether it is for fairness reasons, or capital allocation reasons or simply stopping me worrying – doing something is a really good idea.

Because I would hate to think any of this was enabling behaviours that kept people in business longer than they should. And even with the most whizziest of new IRD computers – there will always be limits on enforcement.

Andrea

(1) Page 116 Paragraph 68

(2) Page 19

(3) Although it would make more sense to only apply this to the extend that the income hasn’t been retained in the business and distributed in non- dividend form.

(4) Yes there is the issue that companies could start adding an extra class of share to get around this. But I don’t believe this is insurmountable with de minimis levels of additional categories and the odd antiavoidance rule for good measure. It is even the advice of KPMG so clearly not that wacky.

Tax and politics

Your correspondent is back from Sydney. Had a great time because – well – Sydney.

Managed to score a gig on a panel at the TP Minds conference talking about international policy developments for transfer pricing. An interesting experience as I am pretty strong in most tax areas except GST – and you guessed it – transfer pricing.

But it was ok as I did a bit of prep and all those years of working with the TP people paid off. And of course I do know a little bit about international tax and BEPS so alg.

Even a techo tax conference again reminded me just how different – socially and culturally – Australia is to New Zealand. Examples include: the expression man in the pub being used without any sense of irony or embarrassment and one of the presenters – a senior cool woman from the ATO – wearing a hijab.

Can’t imagine either in tax circles in NZ.

My particular favourite though was watching the telly which showed a clip of Bill Shorten describing franking (imputation) credits as something you haven’t earned and a gift from the government. Now Australia does cash out franking credits but – wow – seriously just wow. Kinda puts any gripes I might have about Jacinda talking about a capital gains tax into perspective.

And in the short time I have been away yet another minor party has formed as well as the continuation of the utter dismay from progressives over the CGT announcement.

In the latter case I am fielding more than a few queries as to what the alternatives actually are to tax fairness is a world where a CGT has been ruled out pretty much for my lifetime.

Now while I have previously had a bit of a riff as to what the options could be, I have been having a think about what I would do if I were ever the ‘in charge person’ – as my kids used to say – for tax.

To become this ‘in charge person’ I guess I’d also have to set up a minor party although minor parties and tax policies are both historically pretty inimical to gaining parliamentary power.

But in for a penny – in for a pound what would be the policies of an Andrea Tax Party be?

Here goes:

Policy 1: All income of closely held companies will be taxed in the hands of its shareholders

First I’d look to getting the existing small company/shareholder tax base tidied up.

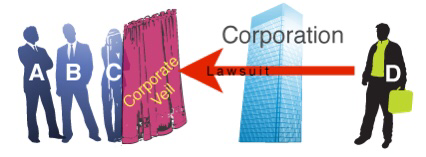

On one hand we have the whole corporate veil – companies are legally separate from their shareholders – thing. But then as the closely held shareholders control the company they can take loans from the company – which they may or may not pay interest on depending on how well IRD is enforcing the law – and take salaries from the company below the top marginal tax rate.

On the other hand we have look through company rules – which say the company and the shareholder are economically the same and so income of the company can be taxed in the hands of the shareholder instead. But because these rules are optional they will only be used if the company has losses or low levels of taxable income.

My view is that given the reality of how small companies operate – company and shareholders are in effect the same – taking down the wall for tax is the most intellectual honest thing to do. Might even raise revenue. Would defo stop the spike of income at $70,000 and most likely the escalating overdrawn current account balances.

So look through company rules – or equivalent – for all closely held companies. FWIW was pretty much the rec of the OG Tax Review 2001 (1).

Now that the tax base is sorted out – if someone wants to add another higher rate to the progressive tax scale – fill your boots. But my GenX and tbh past relatively high income earning instincts aren’t feeling it.

Policy 2: Extensive use of withholding taxes

The self employed consume 20% more at the same levels of taxable income as the employed employed. Sit with that for a minute.

20% more.

Now the self employed could have greater levels of inherited wealth, untaxed capital gains or like really awesome vegetable gardens.

Mmm yes.

Or its tax evasion. Cash jobs, not declaring income, income splitting or claiming personal expenses against taxable income.

Now in the past I have got a bit precious about the use of the term tax evasion or tax avoidance but I am happy to use the term here. This is tax evasion.

IRD says that puts New Zealand at internationally comparable levels (2). Gosh well that’s ok then.

Not putting income on a tax return needs to be hit with withholding taxes. Any payment to a provider of labour – who doesn’t employ others – needs to have withholding taxes deducted.

Cash jobs need hit by legally limiting the level of payments allowed. Australia is moving to $10,000 but why not – say $200? I mean who other than drug dealers carries that much cash anyway?

Claiming personal expenses is much harder. This we will have to rely on enforcement for.

Policy 3: Apportion interest deductions between private and business

Currently all interest deductions are allowable for companies – because compliance costs. Otherwise interest is allowed as a deduction if the funding is directly connected to a business thing.

Seems ok.

What it means though is that for someone with a small business and personal assets such as a house, all borrowing can go against the business and be fully deductible.

Options include some form of limitation like thin capitalisation or debt stacking rules. I’d be keen though on apportionment. If you have $2 million in total assets and $1 million of debt – then only 50% of the interest payable is deductible.

Policy 4: Clawback deductions where capital gains are earned

Currently so long as expenditure is connected with earning taxable income it is tax deductible. It doesn’t matter how much taxable income is actually earned or if other non-taxable income is earned as well.

Most obvious example is interest and rental income. So long as the interest is connected with the rent it is deductible even if a non-taxable capital gain is also earned.

One way of limiting this effect is the loss ringfencing rules being introduced by the government. Another way would be – when an asset or business is sold for a profit – clawback any loss offsets arising from that business or asset. Yes you would need grouping rules but the last government brought in exactly the necessary technology with its R&D cashing out losses (4).

Policy 5: Publication of tax positions

And finally just to make sure my party is never elected – taxable income and tax paid of all taxpayers – just like in Scandinavia will be published. Because if everyone is paying what they ought. Nothing to hide. And would actually give public information as to what is going on.

Options not included

What’s not there is any form of taxation of imputed income like rfrm. It isn’t a bad policy but taxing something completely independent of what has actually happened – up or down – doesn’t sit well with me.

Also no mention of inheritance tax. Again not a bad policy I’d just prefer to tax people when they are alive.

And for international tax I think keep the pressure on via the OECD because the current proposals plus what has already been enacted in New Zealand is already pretty comprehensive.

Now I know none of this is exactly exciting and so I’ll get the youth wing to do the next post.

Andrea

(1) Overview IX

(2) Paragraph 6

(3) Treatment of interest when asset held in a corporate structure

(4) Page 11 onward

Coz everyone else pays their taxes

Now the most logical next post would be a discussion of the OECD digital proposals as that is the international consensus thing I am so keen on and also fits nicely into the thread of these posts.

The slight difficulty is that this requires me to do some work which is always a bit of a drag and when I am suffering badly from jetlag – an insurmountable hurdle.

So as a bit of light relief I thought I’d have a bit of a pick into the narrative around multinationals and why their non-taxpaying is particularly egregious.

You know the whole small business pays tax so large business should too thing.

Now because of the tax secrecy thing, we can never know for def whether this is the case. But there is some stuff in the public domain, so let’s see what we can do as a bit of an incomplete records exercise.

In one of the early papers for the TWG, officials had a look at tax paying of certain industries. Now while the punchline – industries with high levels of capital gains pay less tax – is well known, there are some other factoids that are worth considering.

Factoid 1 The majority of small businesses are in loss (1). Ok wow. But that could be fine if all the income was being paid out to shareholders.

Factoid 2 Spike of incomes at $70k. Ok suspicious I’ll give you that. But maybe there are lots of tax paid trust distributions.

Factoid 3 Shareholder borrowings from the company (2) – aka overdrawn current account balances – have been climbing since the reduction in the company tax rate in 2010. Oh and the imputation credit balances have been climbing over that period too (3). But that could be fine if interest and/or fringe benefit tax is paid on the balances.

Factoid 4 Consumption by the self employed is 20% higher than by the employed for the same taxable income levels. But this could be fine if the self employed have tax paid or correctly un-tax paid – like capital gains – sources of wealth that the employed don’t have.

Factoid 5 In 2014 high wealth individuals had $60 million in losses (4) in their own name. But that could be ok because if companies and trusts have been paying tax and they have been receiving tax paid distributions from their trusts.

Factoid 6 Directors with an economic ownership in their company are rarely personally liable for any tax their company doesn’t pay. Because corporate veil. And that even includes PAYE and Kiwisaver they have deducted from their employees.

Now all of this is before you get to the ability small business has to structure their personal equity so that any debt they take on is tax deductible. Not to mention the whole accidentally putting personal expenditure through the business accounts thing.

And of course I am sure none of this has any relevance to the Productivity Commission’s concern that New Zealand has long tail of low productivity firms [without] an “up or out” dynamic. (5)

But is it all ok?

- Are there lots of taxpaid trust distributions? We know the absolute level (6) but not whether it is ‘enough’.

- Is interest or FBT being paid on overdrawn current accounts?

- Do the self employed have sources of taxpaid wealth that the employed don’t have?

- Why have some of our richest people still got losses?

- How much tax do directors of companies in which they have an economic interest walk away from?

- What is the level of personal expenditure being claimed against business income? Or at least what is the level that IRD counters?

Dunno.

Combination of tax secrecy and information not currently collected. But IRD are working towards an information plan and the TWG have called for greater transparency.

Awesome.

Coz most of this is currently totes legit. In much the same way as the multinationals structures are.

Just saying.

Andrea

(1) Footnote 9

(2) Page 11

(3) Page 10

(4) Page 15

(5) Page 19

(6) Page 9

Taxing multinationals (2) – the early responses

Ok. So the story so far.

The international consensus on taxing business income when there is a foreign taxpayer is: physical presence – go nuts; otherwise – back off.

And all this was totally fine when a physical presence was needed to earn business income. After the internet – not so much. And with it went source countries rights to tax such income.

Tax deductions

However none of this is say that if there is a physical presence, or investment through a New Zealand resident company, the foreign taxpayer necessarily is showering the crown accounts in gold.

As just because income is subject to tax, does not necessarily mean tax is paid.

And the difference dear readers is tax deductions. Also credits but they can stand down for this post.

Now the entry level tax deduction is interest. Intermediate and advanced include royalties, management fees and depreciation, but they can also stand down for this post.

The total wheeze about interest deductions – cross border – is that the deduction reduces tax at the company rate while the associated interest income is taxed at most at 10%. [And in my day, that didn’t always happen. So tax deduction for the payment and no tax on the income. Wizard.]

Now the Government is not a complete eejit and so in the mid 90’s thin capitalisation rules were brought in. Their gig is to limit the amount of interest deduction with reference to the financial arrangements or deductible debt compared to the assets of the company.

Originally 75% was ok but then Bill English brought that down to 60% at the same time he increased GST while decreasing the top personal rate and the company tax rate. And yes a bunch of other stuff too.

But as always there are details that don’t work out too well. And between Judith and Stuart – most got fixed. Michael Woodhouse also fixed the ‘not paying taxing on interest to foreigners’ wheeze.

There was also the most sublime way of not paying tax but in a way that had the potential for individual countries to smugly think they were ok and it was the counterparty country that was being ripped off. So good.

That is – my personal favourite – hybrids.

Until countries worked out that this meant that cross border investment paid less tax than domestic investment. Mmmm maybe not so good. So the OECD then came up with some eyewatering responses most of which were legislated for here. All quite hard. So I guess they won’t get used so much anymore. Trying not to have an adverse emotional reaction to that.

Now all of this stuff applies to foreign investment rather than multinationals per se. It most certainly affects investment from Australia to New Zealand which may be simply binational rather than multinational.

Diverted profits tax

As nature abhors a vacuum while this was being worked through at the OECD, the UK came up with its own innovation – the diverted profits tax. And at the time it galvanised the Left in a way that perplexed me. Now I see it was more of a rallying cry borne of frustration. But current Andrea is always so much smarter than past Andrea.

At the time I would often ask its advocates what that thought it was. The response I tended to get was a version of:

Inland Revenue can look at a multinational operating here and if they haven’t paid enough tax, they can work out how much income has been diverted away from New Zealand and impose the tax on that.

Ok – past Andrea would say – what you have described is a version of the general anti avoidance rule we have already – but that isn’t. What it actually is is a form of specific anti avoidance rule targetted at situations where companies are doing clever things to avoid having a physical taxable presence. [Or in the UK’s case profits to a tax haven. But dude seriously that is what CFC rules are for]

It is a pretty hard core anti avoidance rule as it imposes a tax – outside the scope of the tax treaties – far in excess of normal taxation.

And this ‘outside the scope of the tax treaties’ thing should not be underplayed. It is saying that the deals struck with other countries on taxing exactly this sort of income can be walked around. And while it is currently having a go at the US tech companies, this type of technology can easily become pointed at small vulnerable countries. All why trying for an new international consensus – and quickly – is so important.

In the end I decided explaining is losing and that I should just treat the campaign for a diverted profits tax as merely an expression of the tax fairness concern. Which in turn puts pressure on the OECD countries to do something more real.

Aka I got over myself.

In NZ we got a DPT lite. A specific anti avoidance rule inside the income tax system. I am still not sure why the general anti avoidance rule wouldn’t have picked up the clever stuff. But I am getting over myself.

Of course no form of diverted profits tax is of any use when there is no form of cleverness. It doesn’t work where there is a physical presence or when business income can be earned – totes legit – without a physical presence.

And isn’t this the real issue?

Andrea

#Doubletaxationisgross

Let’s talk about tax.

Or more particularly let’s talk about tax and companies.

Well dear readers what a week it has been in the Beltway. Secret recordings down south and secret payouts from Wellington. All the more bizarre as – Mike Williams confirmed – MPs staffers pretty much have sack at will contracts. If your MP doesn’t like you – that’s it you’re out. No lengthy performance management for them. Facepalm. So maybe this factoid could get added to new MPs induction?

But as always the key issue gets missed. Exactly who under 40 years old knows what a dictaphone is?

And into this maelstom Inland Revenue released a paper on taxation of individuals and some stuff on debt. Both worthy topics of discussion. But then Ryman released its results. And their CEO said like tax is paid – just not like income tax and just like not by them.

So after last week’s post I thought I’d have a look.

Oh yes the real tax is very easily found in the Income Tax Note. Tax losses of $28.9 million in the 2017 year. Up from last year when they were only $15 million of losses. They are a growth stock after all. Quite different from the tax expense which was $6m tax payable.

To your correspondent this looks awfully like her specialist subject of interest deductions for capital profits. All mixed up in a world where interest expense isn’t in the P&L but instead added to the asset value. Complying with both accounting and tax. And yeah totes a tax loophole but one from like whenever.

And again in Ryman’s accounts the rent equivalent from the time value of money of the occupancy advances is in neither the accounting nor the tax profit. Because reasons.

Now expecting controversy the CEO front footed the issue saying that the shareholders paid tax and that Ryman had actually paid GST. He then also referred to the PAYE deducted as they were employers. Kinda going to ignore that bit tho coz the whole claiming credit for other people’s tax really gets on my nerves.

And I’ll take his word on the GST angle coz I am cr@p at GST. But with his shareholders paid the tax comment – he is talking about imputation. And as I haven’t covered that before dear readers – today you get imputation. Oh and other random thoughts on tax and companies.

Now the official gig about imputation is how – notwithstanding that they are separate legal peeps – the company is merely a vehicle for their shareholders to do stuff. So for tax purposes the company structure should – sort of – get looked through to its shareholders. And this means dividends are in substance the same income as company profits and so should get a credit for tax paid by the company.

And as a tax person this stuff is considered to be in the stating the flaming obvious category.

But as I am no longer an insider – I am increasingly finding it interesting just how public policy on companies manages to talk out of both sides of its mouth. And how – much like the sack at will contracts or milliennials using dictaphones – no one has noticed.

On one hand we have the Companies Act which sets up companies with separate legal personalities from its shareholders. Meaning that if you transact with a company and it doesn’t pay you. Bad luck bucko. Nothing to do with the shareholders. Limited liability; corporate veil and all that.

But for tax if you only have a few shareholders those losses can flow through to the shareholders and be offset against against other income. The negative gearing thing but using a company. Coz in substance the company and shareholders are like the same.

And a similar thing happens with the Trust rules. Trust law says that it is trustees that own the assets. And once you have handed stuff over to them as settlor – that’s it – that stuff isn’t yours anymore. So if that settlor owes you money – also bad luck bucko. Don’t for a second think you can approach the trustees – coz whoa – settlor nothing to do with them.

But then tax says – for trusts – as settlors call the shots; it’s the residence of the settlor that is important. Mmmm. This means that a trust with a New Zealand resident trustee and a foreigner wot gave the stuff to the trustee – foreign trust – isn’t taxed on foreign income. Coz that would be like wrong. Even though the assets are owned by a New Zealand resident. And New Zealand residents normally pay tax on foreign income.

Right. Awesome. Thanks for playing.

Anyway back to imputation.

Now put any thoughts of separate legal personalities outside your pretty heads dear readers and think substance. Think companies are vehicles for shareholders. Don’t think about small shareholders having no say or liability if anything goes wrong. Just think one economic unit.

And then you will have no problem seeing potential double taxation if profit and dividends are both taxed. Coz #doubletaxationisgross.

So as part of the uber tax reforms in the late eighties imputation was brought in. Tax paid by the company can be magically turned into a tax credit called – imaginatively – an imputation credit which then travels with a dividend. Creating light and laughter in the capital markets. Or as I have put to me – increased inequality. As when imputation came in it gave dividend recipients – aka well off people – an income boost courtesy of the tax system. Probs also a tax free boost in the share price too.

Now putting aside such inconvenient facts – your correspondent has always defended imputation. Because in order to get the light and laughter or increased inequality – companies actually have to pay tax. And of that – big fan.

But all of this is only useful if shareholders are resident. Coz the credits only have value to New Zealand residents. And this is kind of why foreign companies may not care about paying tax here. And did I mention tax has to actually be paid?

And this last point that brings me back to Ryman’s chairman. He is right. If the company doesn’t pay tax – then the shareholders do when a dividend is paid. So honestly what are we all getting excited about?

Well – profits have to be like actually distributed before that happens and shareholders have to be taxpayers. And Ryman distributes less than 25% of their accounting profit.

And the residence of shareholders? Who knows. Lots of nominee companies listed which could mean KiwiSavers or non-residents. Oh and Ngai Tahu. Who seems to be a charity.

So yeah maybe. Some tax will be paid by some shareholders. That is true. Let’s hope it exceeds the tax losses Ryman is producing.

Andrea

PS. This will be the last post – except if it isn’t – for the next couple of weeks. Your correspondent is getting all her chickens back for a while. And much as I love you all dear readers – I love them more. Until Mid July. Xx

No accounting for tax

Let’s talk about tax.

Or more particularly let’s talk about accounting tax expense.

Now dear readers the most unlikely thing has happened. A tax free week in the media. No Matt Nippert on charities – just for the moment I hope – no Greens on foreign trusts. No negative gearing and – thankfully – no R&D tax credits. So with nothing topical atm – we can return to actually useful and non-reactive posts. And yes I am the arbiter of this. Although the whole Roger Douglas and his #taxesaregross does warrant a chat. Need to psyche into that a bit first though.

So I am now returning to my guilt list. Things I have been asked to write about but haven’t . That list includes land tax; estate duties; some GST things; raising company tax rate; minimum taxes; and accounting tax expense.

And so today picking from the random number generator that is my inclination – you get accounting tax expense.

At the Revenue when reviewing accounts one of the things that gets looked at is the actual tax paid compared to the accounting income. This percentage gives what is known as the effective tax rate or ETR. And yes there are differences in income and expense recognition between accounting and tax but for vanilla businesses – in practice – not as many as you would think.

Now it is true that a low ETR can at times be easily explained through untaxed foreign income or unrealised capital profits. But it is also true that for potential audits it can be a reasonable first step in working out if something is ‘wrong’. Coz like it was how the Banks tax avoidance was found. They had ETRs of like 6% or so when the statutory rate was 33%.

So when I ran into a May EY report that said foreign multinationals operating in New Zealand had ETRs around the statutory rate – I was intrigued.

Looking at it a bit more – it was clear that it was a comparison of the accounting tax expense and the accounting income. Not the actual tax paid and accounting income. Now nothing actually wrong with that comparison but possibly also not super clear cut that all is well in tax land.

And I have been promising/threatening to do a post on the difference between these two. So with nothing actually topical – aka interesting – happening this week; now looks good.

Now the first thing to note is that the tax expense in the accounts is a function of the accounting profit. So if like Facebook NZ income is arguably booked in Ireland – then as it isn’t in the revenues; it won’t be in the profits and so won’t be in the tax expense.

Second thing to note is that the purpose of the accounts is to show how the performance of the company in a year; what assets are owned and how they are funded. One key section of the accounts called Equity or Shareholders funds which shows how much of the company’s assets belong to the shareholders.

And the accounts are primarily prepared for the shareholders so they know how much of the company’s assets belong to them. Yeah banks and other peeps – such as nosey commentators – can be interested too but the accounts are still framed around analysing how the company/shareholders have made their money.

And it is in this context that the tax expense is calculated. It aims to deduct from the profit – that would otherwise increase the amount belonging to shareholders – any amount of value that will go to the consolidated fund at some stage. Worth repeating – at some stage.

First a disclaimer. When IFRS came in mid 2000s the tax accounting rules moved from really quite difficult to insanely hard and at times quite nuts. Silly is another technical term. That is they moved from an income statement to a balance sheet approach. Now because I am quite kind the rest of the post will describe the income statement approach which should give you the guts of the idea as to why they are different. Don’t try passing any exams on it though.

Now the way it is calculated is to first apply the statutory rate to the accounting profit. And it is the statutory rate of the country concerned. That is why it was a dead give away with Apple – note 16 – that they weren’t paying tax here even though they were a NZ incorporated company. The statutory rate they used was Australia’s.

Then the next step is to look for things called ‘permanent differences’. That is bits of the profit calculation that are completely outside the income tax calculation. Active foreign income from subsidiaries; capital gains and now building depreciation are but three examples. So then the tax effect of that is then deducted (or added) from the original calculation.

For Ryman – note 4 – adjusting for non-taxable income takes their tax expense from from $309 million to $3.9 million. That number then becomes the tax expense for accounting.

But there is still a bunch of stuff where the tax treatment is different:

- Interest is fully tax deductible for a company. But – if that cost is part of an asset – it is added to the cost of the asset and then depreciated for accounting. And the depreciation will cause a reduction in the profits over say – if a building – 40-50 years. So for tax interest reduces taxable profit immediately while for accounting 1/50th of it reduces accounting profits over the next 50 years.

- Replacements to parts of buildings that aren’t depreciable for tax can – like interest – receive an immediate tax deduction. But for accounting a new roof or hot water tank are added to the depreciable cost of the building and written off over the life of the asset.

- Dodgy debts from customers work the other way. Accounting takes an expense when they are merely doubtful. But for tax they have to actually be bad before they can be a tax deduction.

These things used to be known as timing differences as it was just timing between when tax and accounting recognised the expense.

And then the difference between the actual cash tax and the tax expense becomes a deferred tax asset or liability. It is an asset where more tax has been paid than the accounting expense and a liability where less tax has been paid than the expense.

And the fact that these two numbers are different does not mean anyone is being deceptive. They just have different raisons d’etre. Now if anyone wants to know how much actual tax is paid – the best places to look are the imputation account or the cash flow statement. The actual cash tax lurks in those places.

But yeah it does look like actual tax. I mean it is called tax expense.

Your correspondent has memories of the public comment when the banking cases started to leak out. I still remember one morning making breakfasts and school lunches when on Morning Report some very important banking commentator was talking. He was saying that the cases seemed surprising coz looking at the accounts the tax expense ratio seemed to be 30%. [33% stat rate at the time]. But that 3% of the accounting profits was still a large number and so possibly worthy of IRD activity.

Dude – no one would have been going after a 3% difference.

In those cases conduit tax relief on foreign income was being claimed on which NRWT was theoretically due if that foreign income were ever paid out. So because of this the tax relief being claimed never showed up in the accounts as it was like always just timing.

Except that the wheeze was there was no actual foreign income. It was all just rebadged NZ income. And yeah that income might be paid out sometime while the bank was a going concern. So it stayed as part of the tax expense. Serindipitously giving a 30% accounting effective tax rate while the actual tax effective tax rate was 6%.

And a lot of these issues are acknowledged by EY on page 13 of under ‘pitfalls’.

So yeah foreign multinationals – like their domestic counterparts – may well have accounting tax expense ratios of 28%. But whether anyone is paying their fair share though – only Inland Revenue will know.

Andrea

#shelterisforpeople

Let’s talk about tax.

Or more particularly let’s talk about the proposed Australian tax on under-utilised properties.

Now in New Zealand the big tax story is how Labour is planning to remove tax breaks from ‘speculators’. Including the best headline ever – ‘Shelter is for people – not for tax‘. Great strap line. I can see the #shelterisforpeople hashtags and possible memes. And all because they are only planning to remove negative gearing.

Now negative gearing is a term used when losses – usually from interest – from renting out a property are deducted from other taxable income. Usually income from a day job. And this kinda is a standard feature of our tax system. All income is added together and then all deductions are offset and tax is paid on the balance.

However with property a major form of income – capital gains – is not included in the calculation. So this does give a degree of tax preference – or shelter – that ordinary businesses don’t get. Is it a loophole? Dunno. Not including capital gain definitely is a loophole. But really the only way interest should actually be allowed even with including capital gains – is if they were taxed every year on an unrealised accrued basis. Now that would really be #shelterisforpeople.

And until that ever happens – no breath holding here – all that second order stuff like removing tax depreciation and negative gearing has a place. Such restrictions also probs still have merit with a realised capital gains tax as can be massive deferral benefits with that. Remember how the retirement villages don’t ever sell?

And of course in all this #shelterisforpeople stuff around negative gearing there is no mention of the other real tax breaks of:

And given the cr@p Labour is getting over this relatively mild proposal – which will only move the tax system towards fairness a tiny bit – I can’t say I blame them. Working group I guess.

And into this mix comes the recent Australian proposals to tax ‘under-utilised’ housing of foreigners. The rhetoric behind it is to free up housing for Australians. And I guess it comes off the reports of large scale empty properties in Sydney. Now recently I watched – with increasing horror – my son and his girlfriend both with incomes and references trying to find a flat in Manly. So I am totes in support of that objective – so long as ‘Australians’ can be also read as bludging Kiwi students. Not entirely sure why it is targetted at foreigners though. Coz exactly why is the nationality of the landlord relevant when the problem is that a house is empty?

Now the actual plan is to impose the charge that is levied when foreigners get permission to buy property in the first place. AUD 5,000 for a property of less than AUD 1 mill and equivalently more thereafter. And much like the Inland Revenue restructure cleverer people than me will have come up with it; but here’s what I don’t get:

- One. If someone is rich enough to own property and not need to rent it out then don’t ya think they can cope with an extra 5-10k expenditure?

- Two. Collectability. Now I get that people will pay if it is the price of getting what they want. But how exactly is this going to be collected from people who have already got the right to buy a new property? And from foreigners who by definition don’t live in Australia much? How is this going to work exactly? There are collection clauses in some treaties but this won’t be a tax covered by them.

- Three. AUD 16.5 m over next three years collected. Really? All this for just $16.5 mill?

Now if this is a big problem such a corrective tax could be put into the mix. But then it needs to be:

- A tax that is penal. So people look to change their behaviour;

- Applied to all under-utilised properties. Coz foreigners only is nuts; and

- Deemed income tax so collection clauses in treaties can be used.

Now there is no mention of an equivalent policy in the Labour stuff. Maybe under-utilised property isn’t a big problem in New Zealand? Even if Gareth does have six. But much like the Bank Levy – let’s not blindly follow the Australians. If we want one let’s make it work.

Andrea

Do ron ron

Let’s talk about tax.

Or more particularly let’s talk about the recent Australian transfer pricing case Chevron.

In a week when Inland Revenue announced a major restructure which will involve staff now needing ‘broad skill ranges’; it made me think of the type of work I used to do there – international tax.

It was true that my job needed skills other than technical ones:

- keeping your cool when being verbally attacked by the other side;

- being able to explain technical stuff to people ‘who don’t know anything about tax’ – aka anyone at Inland Revenue not in a direct tax technical function;

- ensuring the bright young ones got opportunities and didn’t get lost in the system; and

- generally ‘leveraging’ my networks to support those who were doing cutting edge stuff but not getting cut through doing things the ‘right’ way.

But otherwise what I did required a quite narrow specialised technical skill range. And that was good as it allowed me and my colleagues to focus on one particular area so we could be credible and effective. You know kinda like professional firms do?

As an aside I am not sure how this broad skill ranges thing ties in with the original business case – page 36 – which alluded to the workforce becoming more knowledge based. Coz knowledge-based work is kinda specialised not broad. But then the proposals are coming from a Commissioner who has a legal obligation to protect both the integrity of the tax system as well as the medium to long term sustainability of the department so I am sure she knows what she is doing.

Wonder what the penalties are for breaching those provisions? But I digress.

Back to me. The international tax I did though was actually quite broad compared to the work my colleagues did in transfer pricing. That was eye wateringly specialised and quite rightly so. These were the girls and boys who were on the frontline with the real multinationals like Apple, Google, Uber and the like.

And I was thinking of them recently when an appeal from an Australian transfer pricing case Chevron came out. Two wins to the Australian Commissioner and the Australian TP people – woop woo! Go them.

The guts of the case is that Chevron Australia set up a subsidiary in the US which borrowed money from third parties for – let us say – not very much and on lent it to Chevron Australia for – let us say – loads. And it was with a facility of 2.5 billion US dollars. Now you can kinda imagine the difference between not very much and loads on that was a f$cktonne of interest deductions – see why I get obsessed with interest – and therefore profit shifting from Australia to the US.

Now even though it was a subsidiary of Chevron Australia; the Australian CFC rules don’t seem to apply to the US. Coz comparatively taxed country – thank god we don’t have those rules anymore. And the judgment says it wasn’t taxed in the US either. Didn’t spell out why but I am guessing as the Australian companies are Pty ones – check the box stuff – they get grouped in the US somehow. No biggie for US but bucket loads less tax than they would otherwise pay in Australia.

And according to Chevron it was like totes legit. Coz loads is the market price for lots of really risky unsecured debt. I mean seriously dude like look up finance theory.

To which the seriously unbroad people in the Australian Tax Office said – yeah nah. Theory is like only part of it. The test is what would happen with an independent party in that situation.

- Option one – the seriously risky party ponies up with guarantees from those who aren’t seriously risky. You know how those millennials who buy houses and don’t eat smashed avocado do when their parents guarantee their loans? It is the same with big multinationals.

- Option two – banks don’t lend. So just like for all the milennials who don’t own houses but who do eat smashed avocado and don’t have rich parents.

And the Australian court thought about it all – pointed at the unbroad public servants – and said:

“What they said. Chevron you are talking b%llcocks. The arms length price is one an independent party like millennials would actually pay. This includes guarantees and you price on those facts. Not the fantasy nonsense you are spouting.”

Well broadly. Actual wording may vary. Read the judgments.

Now these are seriously useful judgments – internationally – for the whole multinationals paying their fair share thing. Let’s just hope New Zealand keeps the people who can apply them.

Andrea

Shy and retiring

Let’s talk about tax.

Or more particularly let’s talk about how retirement villages don’t pay much tax.

Your correspondent has just returned from Auckland having: topped up her CPD hours; seen old friends and talked with tax peeps. And in that short period while I was away another industry was outed as being non-taxpaying. Now it is retirement villages and they aren’t even foreign.

But don’t panic. Steven Joyce says Inland Revenue is reviewing sectors of the economy which has low tax to accounting profits. And if there is a policy problem it can be put on the policy work programme. Phew.

Now as I have 5 days to complete 3 major pieces of assessment from my yoga course I have had two months to do – the sensible thing would be to put this issue down and pick it up after I have done my assessment. Coz it is not like they about to start taxpaying anytime soon.

But the issue is really interesting.

I am sure 4 days is enough to do all that other work. And I do need breaks from all that right brained stuff. I mean isn’t yoga all about balance?

So let’s have a look at the public stuff dear readers and see if we can’t unpick why these lovely people – much like our multinational friends – aren’t major contributors to the fisc. Now I know there are a few different operators but I thought I’d have a look at Ryman. Who may or may not be representative of the rest of them.

Tax actually paid

Now their tax stuff is interesting. Accounting tax expense of $3.9 million on an accounting profit of $305 million. But accounting tax expense is a total distraction if you want to know how much tax is actually paid. Why? Different rules. Future post I think.

Next place to look – imputation account which increased by $37,000. That can be real tax but can also include imputation credits from dividends received. So close but no cigar.

And then there is the oblique reference in note 4 to their tax losses in New Zealand having increased from $2.5 million in 2015 to $17.9 million in 2016. Bingo! That looks like they made a tax loss of $15 million in 2016 when they made an accounting profit of $305 million. Nice work if you can get it.

Ok now before we get into some exciting detail let’s have a think about what these retirement villages actually do. They can provide hospital services; some provide cafeterias; and they generally keep the place maintained. But mostly they ‘sell’ lifetime rights to apartments and flats on their premises.

Forgone rent

And it is this lifetime rights/apartment thing that is – in your correspondents view – the most interesting.

Looking at Ryman’s accounts and marketing material the deal seems to be residents provide an occupancy advance and get to have undisturbed use of an apartment until they ‘leave’. On ‘departure’ the right will be ‘resold’ and the former resident gets back wot they paid less some fees.

So the retirement village gets the benefit of any capital gain on the apartment as well as the benefit of forgone interest payable on the advance. All comparable to a ‘normal’ landlord who would receive the benefit of rent and capital gain on their property.

And like a ‘normal’ landlord they don’t really know how long the resident or tenant will want to stay. It could be one day or 30 years. But economically this doesn’t matter as the longer the resident stays the less in NPV terms the retirement village has to pay back. So whether landlord gets rent or repayable occupancy advance they both give the same outcome pretax and pre accounting rules. That is with rent over a long period you get lots of rent; with interest free occupancy advances over a long period you get lots of not having to pay interest.

However this isn’t how it pans out for accounting or tax.

For accounting the advances are carried at full value because they could be called immediately – occupancy advances in section j of Significant Accounting Policies. And because of this there is no time value of money benefit ever turning up in the Profit and Loss account – or what ever it is called now. Unlike rent which would get booked to the P&L when it was earned.

And tax is equally interesting. The Ryman gig seems to be that for the occupancy advance the resident gets title under the Unit Titles Act and a first mortgage for the period they are in the property. Fabulous.

Unfortunately your correspondent is about as far away from a property lawyer as it comes. But according to my property law advisor Wikipedia; a leasehold estate is where a person holds a temporary right to occupy land. Kinda looks like what is happening here. So that would be taxable under the land provisons. And even if it isn’t taxable there – to your correspondent – it looks pretty taxable as business income.

But in either case that involves taxing the entire advance and not just the interest benefit. Seems a bit mean.

Deductions

True. But let’s look at deductions before we call meanness.

Tax deductions are allowed when expenses are incurred or legally committed to. Not when actually paid. So if you are a yoga teacher and you commit to a Tiffany Cruikshank course in Cadiz in May 2017 – she is here in Wellington ATM so exciting – paying the USD 500 deposit in April 2016 you can take a deduction for the full amount of USD 2790 in the 2016/17 tax year. Even though you don’t pay it until closer to the actual course. Tax geeks yeah I am talking about Mitsubshi.

So for our retirement village friends as they are committed to repaying the occupancy advance in the future on the day they receive it. Immediate deductibility which cancels any taxable income. Mmm.

Tbf though the tax act isn’t big on the whole time value of money thing.

Financial arrangement rules

The exception is the financial arrangement rules where embedded interest can be spread over the term of the loan. And there is even a specific determination that deals with retirement villages. Now that seems to have more bells and whistles than is obvious from Ryman’s accounts so not entirely sure it relates to them. But there is one bit that could apply as the determination does say that the repayable occupancy advance is considered to be a loan.

Except even this gives no taxable income. This is because value coming in is compared to expected value going out. And of course THEY ARE THE SAME AMOUNT! So nowt to bring in as income.

Fixing it

Fixing this gap it would involve imputing some form of interest benefit that was in lieu of rent. But what interest rate to use? What is the term? And then there is the whole thing that no one actually sees it as a lease agreement. Everyone sees it as ‘ownership’ with a guaranteed sale price back.

Also entirely possible that what I consider to be blindingly obvious; cleverer people than me may consider to be – well – wrong.

Interest deductions

Then we get to much more old school techniques interest deductions to earn capital gains. And here Ryman seems to capitalise interest into new builds – section e of Significant Accounting Policies – rather than expense it for accounting. So there will be whole bunch of interest expense that isn’t in the P&L that will be on the tax return.

Unrealised capital gains

And finally thanks to NZ IRFS 13 – really does roll off the tongue doesn’t it – their accounting profits note 7 include a bunch of revaluations on their investment properties which I am guessing is the apartments. Bugg€r with this is that even a realised capital gains tax wouldn’t touch this and doesn’t look like these guys sell. Gareth’s thing though would work a treat as all the unrealised gains are on the balance sheet.

So here we have a property business that gets interest deductions; doesn’t pay tax on its capital gains or its imputed rent. Gains go on the P&L but not the interest expense. All while being totally compliant with tax and accounting.

No wonder they are share market darlings.

Andrea

Update

Thinking about the occupancy advances some more – depending on the counterfactual – maybe the value is in the tax system already as a reduced interest deduction.

The properties need funding somehow. Usually the options are debt which generates a deductible interest payment; equity which is subject to imputation or a combination of both. Here the assets are partially funded by the interest free occupancy advance. If the residents just paid rent – the assets would then need more capital. This could be completely debt funded which would mostly offset the rental income. May even exceed it if there was an expectation of a large capital gain. So while the occupancy advance is not in the tax system; neither is the extra interest deduction.

So maybe it is all an old school interest deduction for untaxed capital gain thing. But one for which a realised CGT would be useless as they don’t sell.

May need to look at Gareth’s thing again.

Fairness – Take two!

Let’s talk about tax.

Or more particularly let’s talk about tax and fairness.

On leaving the bureaucracy last year there were two issues that drove me absolutely mental and I wanted to put my energies into. The first was the rising prison population at a time of falling crime rates and the second was homelessness. Since then with the former I have become the policy coordinator for JustSpeak and a trustee for Yoga Education in Prisons Trust. For the latter – zip.

So with that in mind I went to a recent Labour Party thing on Housing stuff. But about mid way Phil Twyford said that the Labour Party in its first term of office was going to do a comprehensive review of the tax system to improve its fairness. Now I have heard them talk about this before – but comprehensive review. Wow.

Since then Andrew Little has said they aren’t putting up taxes. So maybe this means this working group will be ‘tax neutral’ in the way Bill English’s was?

Now on the basis that this isn’t simply code for a capital gains tax, I thought I’d do a bit of a scan as to what this could mean in practice. My focus will be on the revenue positive items as the tax community will have their own laundry list of revenue negative ‘unfairnesses’ they will want fixing.

But first I am going to get over myself. Yes fairness could mean a poll tax but when the Left talks about tax and fairness it is implicitly a combination of horizonal and vertical equity. Horizontal equity where all income is taxed the same way and Vertical equity where tax rises in proportion to income.

Alternatively tax and fairness to the Left can also mean using the tax system to remove or reduce structural inequities in the economy and not just in the tax system itself. So here we go:

Untaxed income

Capital income

Now the most obvi unfair thing is the way capital income is taxed more lightly than labour income. Always loved Andrew Little’s comment about the average Auckland house earning more than the average Auckland worker. Dunno why he doesn’t use it more.

Now the lighter taxation might be there for some good reasons including:

- Long periods before it is realised. Is it fair to tax people when don’t have cash to pay the tax?

- Valuation issues. Although this goes once move to realisation based taxes.

- International norm. Soz unfortunately everyone taxes capital more lightly – sigh.

- Lock in effect. If have to pay tax would you ever sell?

- Incentive for entrepreneurship which is a good thing apparently.

Oh and not being able to get elected.

Options include a realised capital gains tax or Gareth’s wealth taxation thing. Both have issues but both would be an improvement if fairness or horizontal equity is your thing.

Imputed rents

Alongside the not taxing capital gains is that we don’t tax imputed rents. Remember how owning your own home is effectively paying non-deductible rent to yourself and earning taxable rent? Except the value of the rent is not taxed? Awesome. But its non-taxation also offends the horizontal equity thing – even if it is your house – and so is unfair.

Active income of controlled foreign companies

New Zealand companies that earn foreign business income in their own names are taxed. New Zealand companies that earn foreign income through a foreign company aren’t. Why? International norm. Not fair but everyone else does that too. Also brought in by Michael Cullen. Nuff said.

Capital or wealth taxation

While Gareth’s thing is potentially wealth taxation it really is taxation of an imputed or deemed return on wealth rather than a tax on wealth per se. Actually taxing capital or wealth is where inheritance or gift duties come in.

Now neither of them are actually income taxes. They are outright taxes on capital. And if that capital arose from taxed income then would be very unfair to tax. However not entirely sure that is the case and these taxes are relatively painless as they tax windfalls; don’t effect behaviour and only apply to the well off. So they potentially promote fairness from a ‘reducing inequality’ sense rather than a horizontal or vertical equity sense.

Deductions

There are a few things here. There are all the issues with interest and capital gains but they reduce if you ever tax capital gains or do Gareth’s thing. Others include:

- Borrowing for PIE investment can get deductions at 33% while PIE income is taxed at 28%

Donations tax credit

Now this isn’t an obvious one as everyone can get a third back of their donations up to their total taxable income. So that is pretty fair. But the more taxable income you have the more subsidy you get. And it can go to a decile 10 school; your own personal charity or a church with an interesting back story. But dude – seriously – who can afford to give away all their taxable income? Perhaps worth a little look.

Labour income

Withholding taxes

Labour income that is earned as an employee is subject to PAYE and no deductions are allowed. Labour income that is earned as a contractor is only sometimes subject to withholding taxes and deductions are allowed. Aside from deductions which are likely to be pretty minimal with most employee type jobs – there is an evasion risk when people become responsible for their own tax. Spesh when such people are on very low incomes. Whole bunch of other ‘fairness’ issues too like access to employment law; but this is just a tax post.

Personal companies

Labour – and any income – can also be earned through a company. And a company is only taxed at 28% while the top rate is 33%. So if you don’t need all that income to live off you can decide how much stays in the company and how much you pay yourself. Is that fair?

Other things

Now of course there is always the old staple – increasing the top marginal tax rate. And yes that does enhance vertical equity but it also causes other problems elsewhere. So if you are going to make the system more misaligned please make sure that it doesn’t become the backdrop for widespread income shifting as it did last time.

Oh and secondary tax. Now there are many things that are unfair including precarious work and over taxation. Not sure secondary tax is one of them. While you have a progressive tax scale and multiple income sources – you get secondary tax. It appears that under BT – page 22 – the edges can be taken off getting a special tax code which should help but secondary tax in some form is structurely here to stay.

Look forward to it all playing out.

Andrea