Last week was a big week for your correspondent.

On Wednesday I got to upgrade my CA certificate to a FCA one at a posh dinner at Te Papa. As a third generation accountant I was absolutely tickled pink by that.

Interestingly of the 12 Wellington people there were 5 tax people: Me, Mike Shaw, Suzy Morrissey, Stewart Donaldson and Lara Ariel. All except Lara I have had the great pleasure to work with personally and professionally over the years.

I got to give a wee talk and so thanked my Wakefield (mother’s accountant line) genes; the balance sheet for being able to distinguish between the concept of capital as an asset or net equity – a framework other professions lack; and Inland Revenue Investigations as both the employer of my proposers and the place of some of the highlights of my personal and professional life.

I gave a slightly longer talk on the Tuesday. Twelve minutes instead of two.

The theme of that seminar was options to improve fairness now that extending the taxation of capital gains was off the table. The punchline of my talk was that the company tax rate should be raised.

I had come to that point following lots of feedback on my tax and small business post.

Very experienced tax people were sympathetic to my concerns but the ideas of mandating the LTCs rules or restricting interest deductions or even a weighted average small company tax rate sent them over the edge with the compliance costs involved. Their preference was that it was just simpler all round to increase the company tax rate with adjustments such as allowing the amount of deductible debt for non-residents.

And so on Tuesday I had a go at putting that argument.

Clearly not well as Michael Reddell described the argument as cavalier given NZ’s productivity issues.

Regular readers will know I am concerned about whether the tax system is a factor in New Zealand’s long tail of unproductive firms without an up or out dynamic. And that is before we get to any well meaning – but not always hitting the mark – collection of small companies tax debts inadvertently providing working capital for failing firms.

Although I had twelve minutes to talk on Tuesday, the company tax punchline really only got a minute or two to expand. So I’ll try and have a better go at it here. (1)

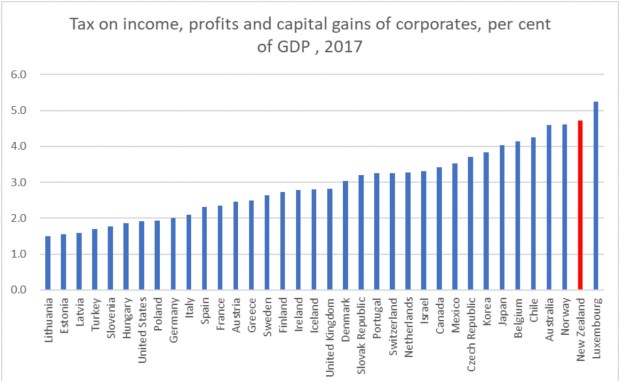

Now before we get to the arguments in favour of a company tax increase, Michael referred to this table as prima facie indicating that business income is not overtaxed.

Yep.

This table absolutely shows that second to – that other well known high tax country – Luxembourg, New Zealand’s company tax take is the highest in the OECD as a percentage of GDP.

My difficulty is that – in a New Zealand context – I struggle to call the company tax collected – a tax on business income.

Absolutely it includes business income.

But it also includes tax paid by NZ super fund – the country’s largest taxpayer and Portfolio Investment Entities which are savings entities. In other countries such income would be exempt or heavily tax preferred. And yes I know there are arguments about whether they are the correct settings or not but all that tax is currently collected as company tax.

Also, for all the vaunted advantages of imputation, the byproduct of entity neutrality is the potential blurring of returns from labour and capital for closely held companies. So – and particularly with a lower company than top personal rate – there will always be income from personal exertion taxed at the company rate.

And business income is also earned in unincorporated forms such as sole trader or partnership. All subject to the personal progressive tax scale rather than the flat company rate.

Australia’s company tax is also high but less so. Possibly a function of their lower taxation on superannuation than New Zealand or even that such income is classified according to its legal form of a trust.

And all that is before we get to issues like classical taxation in other countries encouraging small businesses to choose flow through options to avoid double taxation. An example is S Corp in the US. Tax paid under such structures will not be shown in the above numbers as the income is taxed in the hands of the shareholders.

It is true that we have a similar vehicle here in the look through company. But unsurprisingly, under imputation, this is used primarily for taxable incomes of under $10k. It is quite compliance heavy and does require tax to be paid by the shareholder while it is the company that has the underlying income and cash. But it is elective and seems to be predominantly currently used as a means of accessing corporate losses.

But back to tax fairness and company taxation.

The argument put to me by my friends – with more practical experience than I have – was: if you want to increase the level of taxation paid by the people with wealth – increase the company tax rate as that is the tax rich people pay. The logical tax rate would be the trust and top personal rate – currently 33%.

That company tax is the tax rich people pay is absolutely true. The 2016 IR work on the HWI population shows exactly that:

It would also mean that the rules that other countries have like personal services companies or accumulated earnings – that we absolutely need with a mismatch in rates – no longer become necessary.

But what about foreign investment through companies?

If the focus was New Zealanders owning closely held New Zealand businesses, an adjustment could be made either by increasing the thin capitalisation debt percentage or making a portion – most likely 5/33 – of the imputation credit refundable on distribution.

However there is also an argument not to do this. The relatively recent cut in the company tax rate has not particularly affected the level of foreign investment in New Zealand. (2)

Personally I am agnostic.

Listed companies?

Based on officials advice to the TWG (3) this group fully distributes its taxable income. So if the company tax rate increased all this would mean was that resident shareholders received a full imputation credit at 33% rather than one at 28% and withholding tax at 5%.

What happened to non-resident shareholders would depend on the decision above on non-resident investors. Either they would pay more tax on income from NZ listed companies or there could be a partially refundable imputation credit to get back to 28c.

The top PIR rate for PIEs could now also be increased to the top marginal tax rate for individuals as I keep being told the 28c rate is not a concession – more to align it with the unit trust or company tax rate. Or maybe KiwiSavers stay at 28% alongside an equivalent reduction for lower rates.

Start ups already have access to the look through company rules and so some more may access those rules if the shareholders marginal rates were below an increased company tax rate.

So an increase in the company tax rate need not have a material impact on foreign investment, listed companies and start ups.

Which then brings us to profitable closely held companies. Ones where the directors have an economic ownership of the company. A lower tax rate should, on the face of it, have allowed retained earnings and capital to grow faster. And therefore allow greater investment.

And on the face of it that is what has seemed to happen with this group. Imputation credit balances have climbed since the 28% tax rate meaning that tax paid income has not been distributed to shareholders.

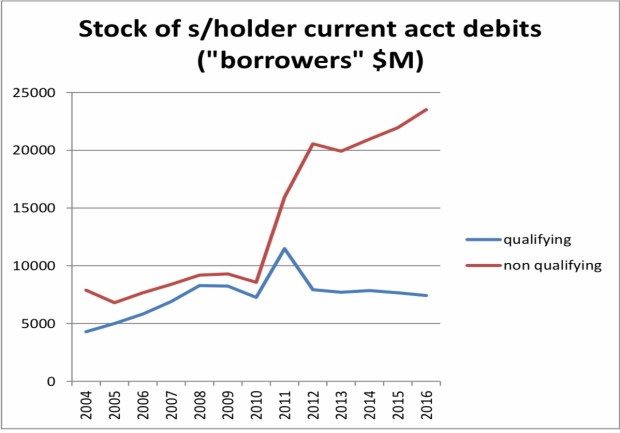

However loans from such companies to their shareholders have also climbed indicating that value is still being passed on to shareholders – just not in taxable dividend form.

Now yes shareholders should be paying non-deductible – to them – interest to the company for these loans but it is more than coincidental that this increase should happen when there is a gap between the company rate and that of the trust and top personal tax rate.

And alongside this was an increase in dividend stripping as a means of clearing such loans.

So an increase in the company tax rate would reduce those avoidance opportunities and align the tax paid by incorporated and unincorporated businesses.

And with more tax collected from this sector, Business would have a strong argument for more tax spending on the things they care about. Things like tax deductions in some form for seismic strengthening, setting up a Tax Advocate, or the laundry list of business friendly initiatives that get trotted out such as removing rwt on interest paid within closely held groups.

Some of which might even be productivity enhancing.

For the next few months, I am returning to gainful – albeit non-tax – employment. As it is non-tax there should be no conflicts with this blog except for my energy and – possibly – inclination.

I am hopeful that at least two guest posts will land over this period and you may still get me in some form.

But otherwise I will be maintaining the blog’s Facebook page, and am on Twitter @andreataxyoga. I can also recommend Terry Baucher’s podcasts – the Friday Terry – when he isn’t swanning around the Northern Hemisphere.

Andrea

(1) Officials wrote a very good paper for the TWG on company tax rate issues. It can be found here: https://taxworkinggroup.govt.nz/sites/default/files/2018-09/twg-bg-appendix-2–company-tax-rate-issues.pd

(2) Paragraph 33 for a discussion of this graphs limitations. These include a reduction in the amount of deductible debt and depreciation allowances at the time of the reduction to 28% which would have worked in the opposite direction to the tax cut.

(3) Paragraph 11

If the policy objective is to raise more tax from the wealthy then it does seem logical to focus on the 75% of income they earn in companies not the 5% they derive personally. In this light a policy of reducing company tax rates (reducing tax on the 75%) and increasing tax rates on individuals (covering 5%) seems (to be very generous) quixotic. Obviously also need to consider impact of investment of taxing more but a different issue. Anyway Andrea very sensible.

LikeLiked by 1 person