#shelterisforpeople

Let’s talk about tax.

Or more particularly let’s talk about the proposed Australian tax on under-utilised properties.

Now in New Zealand the big tax story is how Labour is planning to remove tax breaks from ‘speculators’. Including the best headline ever – ‘Shelter is for people – not for tax‘. Great strap line. I can see the #shelterisforpeople hashtags and possible memes. And all because they are only planning to remove negative gearing.

Now negative gearing is a term used when losses – usually from interest – from renting out a property are deducted from other taxable income. Usually income from a day job. And this kinda is a standard feature of our tax system. All income is added together and then all deductions are offset and tax is paid on the balance.

However with property a major form of income – capital gains – is not included in the calculation. So this does give a degree of tax preference – or shelter – that ordinary businesses don’t get. Is it a loophole? Dunno. Not including capital gain definitely is a loophole. But really the only way interest should actually be allowed even with including capital gains – is if they were taxed every year on an unrealised accrued basis. Now that would really be #shelterisforpeople.

And until that ever happens – no breath holding here – all that second order stuff like removing tax depreciation and negative gearing has a place. Such restrictions also probs still have merit with a realised capital gains tax as can be massive deferral benefits with that. Remember how the retirement villages don’t ever sell?

And of course in all this #shelterisforpeople stuff around negative gearing there is no mention of the other real tax breaks of:

And given the cr@p Labour is getting over this relatively mild proposal – which will only move the tax system towards fairness a tiny bit – I can’t say I blame them. Working group I guess.

And into this mix comes the recent Australian proposals to tax ‘under-utilised’ housing of foreigners. The rhetoric behind it is to free up housing for Australians. And I guess it comes off the reports of large scale empty properties in Sydney. Now recently I watched – with increasing horror – my son and his girlfriend both with incomes and references trying to find a flat in Manly. So I am totes in support of that objective – so long as ‘Australians’ can be also read as bludging Kiwi students. Not entirely sure why it is targetted at foreigners though. Coz exactly why is the nationality of the landlord relevant when the problem is that a house is empty?

Now the actual plan is to impose the charge that is levied when foreigners get permission to buy property in the first place. AUD 5,000 for a property of less than AUD 1 mill and equivalently more thereafter. And much like the Inland Revenue restructure cleverer people than me will have come up with it; but here’s what I don’t get:

- One. If someone is rich enough to own property and not need to rent it out then don’t ya think they can cope with an extra 5-10k expenditure?

- Two. Collectability. Now I get that people will pay if it is the price of getting what they want. But how exactly is this going to be collected from people who have already got the right to buy a new property? And from foreigners who by definition don’t live in Australia much? How is this going to work exactly? There are collection clauses in some treaties but this won’t be a tax covered by them.

- Three. AUD 16.5 m over next three years collected. Really? All this for just $16.5 mill?

Now if this is a big problem such a corrective tax could be put into the mix. But then it needs to be:

- A tax that is penal. So people look to change their behaviour;

- Applied to all under-utilised properties. Coz foreigners only is nuts; and

- Deemed income tax so collection clauses in treaties can be used.

Now there is no mention of an equivalent policy in the Labour stuff. Maybe under-utilised property isn’t a big problem in New Zealand? Even if Gareth does have six. But much like the Bank Levy – let’s not blindly follow the Australians. If we want one let’s make it work.

Andrea

Do ron ron

Let’s talk about tax.

Or more particularly let’s talk about the recent Australian transfer pricing case Chevron.

In a week when Inland Revenue announced a major restructure which will involve staff now needing ‘broad skill ranges’; it made me think of the type of work I used to do there – international tax.

It was true that my job needed skills other than technical ones:

- keeping your cool when being verbally attacked by the other side;

- being able to explain technical stuff to people ‘who don’t know anything about tax’ – aka anyone at Inland Revenue not in a direct tax technical function;

- ensuring the bright young ones got opportunities and didn’t get lost in the system; and

- generally ‘leveraging’ my networks to support those who were doing cutting edge stuff but not getting cut through doing things the ‘right’ way.

But otherwise what I did required a quite narrow specialised technical skill range. And that was good as it allowed me and my colleagues to focus on one particular area so we could be credible and effective. You know kinda like professional firms do?

As an aside I am not sure how this broad skill ranges thing ties in with the original business case – page 36 – which alluded to the workforce becoming more knowledge based. Coz knowledge-based work is kinda specialised not broad. But then the proposals are coming from a Commissioner who has a legal obligation to protect both the integrity of the tax system as well as the medium to long term sustainability of the department so I am sure she knows what she is doing.

Wonder what the penalties are for breaching those provisions? But I digress.

Back to me. The international tax I did though was actually quite broad compared to the work my colleagues did in transfer pricing. That was eye wateringly specialised and quite rightly so. These were the girls and boys who were on the frontline with the real multinationals like Apple, Google, Uber and the like.

And I was thinking of them recently when an appeal from an Australian transfer pricing case Chevron came out. Two wins to the Australian Commissioner and the Australian TP people – woop woo! Go them.

The guts of the case is that Chevron Australia set up a subsidiary in the US which borrowed money from third parties for – let us say – not very much and on lent it to Chevron Australia for – let us say – loads. And it was with a facility of 2.5 billion US dollars. Now you can kinda imagine the difference between not very much and loads on that was a f$cktonne of interest deductions – see why I get obsessed with interest – and therefore profit shifting from Australia to the US.

Now even though it was a subsidiary of Chevron Australia; the Australian CFC rules don’t seem to apply to the US. Coz comparatively taxed country – thank god we don’t have those rules anymore. And the judgment says it wasn’t taxed in the US either. Didn’t spell out why but I am guessing as the Australian companies are Pty ones – check the box stuff – they get grouped in the US somehow. No biggie for US but bucket loads less tax than they would otherwise pay in Australia.

And according to Chevron it was like totes legit. Coz loads is the market price for lots of really risky unsecured debt. I mean seriously dude like look up finance theory.

To which the seriously unbroad people in the Australian Tax Office said – yeah nah. Theory is like only part of it. The test is what would happen with an independent party in that situation.

- Option one – the seriously risky party ponies up with guarantees from those who aren’t seriously risky. You know how those millennials who buy houses and don’t eat smashed avocado do when their parents guarantee their loans? It is the same with big multinationals.

- Option two – banks don’t lend. So just like for all the milennials who don’t own houses but who do eat smashed avocado and don’t have rich parents.

And the Australian court thought about it all – pointed at the unbroad public servants – and said:

“What they said. Chevron you are talking b%llcocks. The arms length price is one an independent party like millennials would actually pay. This includes guarantees and you price on those facts. Not the fantasy nonsense you are spouting.”

Well broadly. Actual wording may vary. Read the judgments.

Now these are seriously useful judgments – internationally – for the whole multinationals paying their fair share thing. Let’s just hope New Zealand keeps the people who can apply them.

Andrea

Cry me a river

Let’s talk about tax. Yes dear readers – tax. No prison reform no yoga stuff. Just nice emotionally simple tax.

Or more particularly let’s talk about the recent Australian Budget announcement of a levy on banks aka the Great Australian Bank Robbery.

Your correspondent has now completed her yoga teacher training and so is available for weddings, funerals and bar/bat mischvahs. Highlights of the course included injuring herself while dancing and getting zero on the first attempt on the final exam.

It’s not like I haven’t failed things before but when the question was – reminiscent of the Peter Cook coal miners sketch – ‘who am I?‘ to fail – mmm – more than a little surreal. Now even the first time thought I had answered in a sufficiently right brained way – lots of introspective emotion involving personal power and connection with others – aahhh no.

But your correspondent is a resilient adaptive individual – even before the course – so regrouped with – ‘complete‘.

90%.

I couldn’t make this up. Subsequently found other correct answers included: me; enough – and my particular favourite – light. Ok right. Thanks for sharing.

And it all really did make me crave balance. Which in my world after eight full days on yoga is the left-brained world of tax. I had planned to write about the Australian transfer pricing case Chevron but this week has been the Australian Budget with a big new tax on their banks. And as I have had a few questions on this and I am trying to be more topical – here we go:

Now the bank tax thing seems to be part of a package of the Australian government responding to the Australian banks bad – but probs more likely monopolistic – behaviour. Also potentially a political response to appointing a popular Labour Premier – and good god a woman – to be head of the Bankers Association. And my word the banks must have been bad as they only found out about it on Budget Day and it starts on 1 July without – as far as I can see – any grandfathering.

Wow. Just wow.

So what is it?

It is a levy on big banks liabilities that aren’t:

- customer deposits or

- (tier 1) equity that doesn’t generate a tax deduction.

It targets commercial bonds, hybrid instruments (tier 2 capital) and other instruments that smaller banks can’t access coz they are small. And as it will form part of the cost of this borrowing- under normal tax principles – the levy would be tax deductible. But even allowing for this tax deduction it is supposed to raise AUD 6.2 billion over four years. So not chump change.

What is its effect?

Now there can be no argument that the levy will effectively make such instruments more expensive to use. And here the public arguments get really sophisticated:

- Malcolm Turnbull says that ‘other countries have them’ and it would be ‘unwise’ for banks to pass it on to borrowers; and

- the Treasurer Scott Morrison (ScoMo) is telling banks to ‘cry me a river’ when they have expressed a degree of displeasure.

Awesome. Thanks for playing.

Corrective taxation

Now while this is predicted to raise revenue; it is by no means clear that this is its primary objective or even if it will occur. The reason being it only applies to big banks and to certain types of liabilities. To me this looks like a form of corrective tax like cigarette excise rather than a revenue raiser like an income or consumption tax like GST.

And much like a tax on cigarettes; pollution or congestion; this tax is 100% avoidable – legitimate tax avoidance even – by funding lending with an untaxed option like customer deposits. In theory anyway. It is likely that banks will have maxxed out how much they can borrow from the public at existing interest rates.

But with this extra tax; the relativities will change. Meaning there is now scope to pay more for the untaxed deposits but less than the tax if Banks want to maintain the same level of lending. Bank costs will still go up but through marginally higher deposit rates incentivised through the tax – rather than the tax itself.

In this scenario the Australian government still gets the costs of the higher interest deduction but not the revenue. But Australian savers win.

As the big banks are the dominant players in the market – this increase in interest rates for depositors will also impact the smaller banks as they will need to pay the higher rates to continue to attract depositors too. So no actual competitive pressure from the small banks and possibly less actual tax. Genius.

An alternative equally revenue enhancing scenario is that banks wind down assets – lending – and become smaller. Less lending but higher cost of borrowing if demand stays the same.

Who bears the cost?

As they do in New Zealand anytime extra taxes are mooted; the Australian banks are arguing that these extra costs will be borne by borrowers. Now in a fully competitive market without barriers to entry the more price dependent – or elastic – the demand for loans is the more it will fall on the shareholders. But lending overall will fall with the imposition of a tax which in turn will have housing market impacts if fewer people can get a mortgage.

With barriers to entry – like hypothetically say banking regulation – they are already pricing to maximise their profit so I would be inclined to say it will also hit shareholders. And the fall in price of banking shares would indicate that is what shareholders think too.

Except that if deposit rates go up instead; the cost structure of the entire banking industry will go up. And if no tax is actually being paid but the cost is being transferred through higher deposit rates then the banking industry will have political cover to pass the cost on to borrowers.

Alternatives

Now if this schmoozle is all about the banks paying more tax then either a higher company tax rate on big banks or increasing the requirements for non- interest bearing capital would have been far simpler. While the former is pretty transparent that it is a blatant tax grab from the banks; the latter less so. They both have the advantage though of ensuring tax can’t be opted out of as well as keeping the competitive pressure from the smaller banks.

But both would form part of the banks cost structure and so – depending on the pressure from the small banks and how elastic demand is – be passed on in some form to borrowers. However if the government really wanted only the shareholders to pay then a one- off windfall tax would be the way to do it.

Whether or not the banks – and their shareholders – should actually be treated like this is another story. But Cry me a river ScoMo: at least be transparent and do it properly!

Other stuff

It goes without saying that this is truly cr@p process. All the detail seems to be in ScoMo’s press statement. Although – legislation by press statement – is an unfortunate feature of Australian tax policy.

And as for the Malcolm Turnbull ‘other countries have it too’ argument. From what I can see this was to pay back the government for the bail outs they gave the banks over the GFC. While Australia does have deposit insurance I wasn’t aware of any like actual bailouts.

It is though kinda reminiscent of the diverted profits tax which is also a targetted tax on a group of bad people. Except that might have a non-negative tax effect. Here we have – to extent it is passed on in higher deposit rates – higher costs industry wide causing less, not more, tax paid by this industry. Let’s just hope for Australia’s sake the savers are not all in the tax free threshold.

So nicely done ScoMo and Big Malc. Possibly more Lavender Hill mob than Ronnie Biggs. But much like the Australian fruit fly; keep it on your side on the Tasman. It makes even this revenue protective commentator blanch and our banking tax base can so do without it.

Andrea

Update

A commentator on the blog’s facebook page has suggested that this levy makes sense in terms of addressing the huge implicit subsidy that is the Australian deposit guarantee scheme. I have absolutely no issue with this being charged for in the form of a levy on the banks. Naively I would have thought that such a levy would then be based on the deposits covered by the guarantee not the liabilities that aren’t. Apparently that’s not how Australian politics works!

The discussion can be found in the Facebook comments section for this post.

I am into champagne

Let’s (not) talk about tax.

Let’s talk about yoga stuff.

As part of her assessment for yoga teacher training your correspondent has had to read B K S Iyengar’s Light on Life and write 500 words on something that ‘spoke to me’. As 500 words is blog length and we have now all handed in our essays I thought I’d post it as a bit of ‘light’ relief after all the tax stuff.

Think of it – dear readers – as the blog equivalent of alternate nostril breathing which is supposed to balance out the hemispheres of your brain. Although that exercise after a couple of rounds doesn’t so much balance out your left brained correspondent as make her want to run screaming from the room. So like all yoga; work with your comfort levels and rest or stop when you need to. Listen to your body.

But first a bit of background. Yoga is not actually what non-yogis think it is. Non-yogis think of it in terms of contortionist poses – that they are like far too stiff or inflexible to do. And this isn’t helped by the whole instayogi thing. Beautiful fit young people doing postures average people can’t do on beaches or tropical islands that average people can’t afford to go to.

There are 8 limbs of yoga: the postures or asanas are but one of them. And that not to under rate them. As an ex runner I would say: come for the flexibility; stay for the brain calming and inner peace.

I had hoped to work in the ideas of Marianne Elliott social activist and yoga teacher. In particular her framework for progressive social change which I have paraphrased (and adjusted slightly) as involving:

- The official rules laws and structures we live by;

- How we treat each other; and

- How we treat ourselves.

And it is in the latter that yoga is referenced. But the essay I have to write is very short and I didn’t start soon enough to do a decent job with both Marianne’s and Iyengar’s ideas. For people who are interested in this combination I would suggest reading direct from Marianne’s work and skipping the rest of this post.

And yes this will be the last non-tax post for a while. Yes it is a tax blog and I will return to tax stuff in a couple of weeks after my teacher training is over.

Andrea

“We have been asked to read Iyengar’s Light on Life and write about what spoke to us. It is fair to say that yoga has changed my life. But not in a way that is particularly obvious from the outside.

My family has REALLY BAD GENES meaning living as long as I would like may not be possible. So I have organised my life to ‘do something different’ when I turned 50. That ‘something different’ broadly is working for progressive social change.

So this was in my head reading Light of Life. To be fair while I struggled with the book; there were a few things that really did resonate with me:

Role of asana

Iyengar says that asana is the physical process that relaxes the mind which in turn allows pranayama – breathing – to unlock the prana – energy – blockages in the body. Which in turn calms and focuses the mind.(Page 14)

This is absolutely my experience. In the time leading up to my fiftieth birthday I had many competing ideas and emotions. Normally would rush to decisions that may or may not be the right ones for me and those around me.

Now it was my physical yoga practice that I kept coming back to. It might have sorted out my posture but more importantly it kept my mind clear and proceeding with calmness and focus.

I am a little nervous though of his concept of right pain as a tool for growth (page 49). As what I had thought to be ‘right pain’ in chaturanga has lead to a shoulder I am still trying to fix a year later.

Asteya and Aparigahaha

Non-stealing and non-covetousness like non-violence ahimsa, are tenets that are blindingly obvious ones for any philosophy. Iyengar, however, takes them further than I have seen before.

Non-stealing includes not taking more than you need. When combined with non-covetousness this means that taking more than you need could mean deprivation for others. And to Iyengar wealth being tied up in a few hands is also theft or covetousness.

To be faithful to these yamas wealth – as energy – must circulate otherwise ‘it will stagnate and poison us’. ‘Energy needs to flow or its source withers.’ (Page 245) This particularly resonated with me given according to Oxfam 8 men have as much wealth as half the world.

What I am increasingly seeing in New Zealand – through our out-of-whack property market – is wealth being captured through those that own property from those that don’t. And so by capturing all the wealth we are poisoning our children’s potential to live the lives we have lead.

But here’s the thing. Those who have the most won’t let that happen to their children. So opportunity and material comfort will only be available to the children of families that already have it. The exact social ill that families such as mine were escaping 100 years ago by coming to New Zealand.

So although Iyengar’s primary message was of one of inner freedom – embedded in that was the other eternal truth – that the personal is political.”

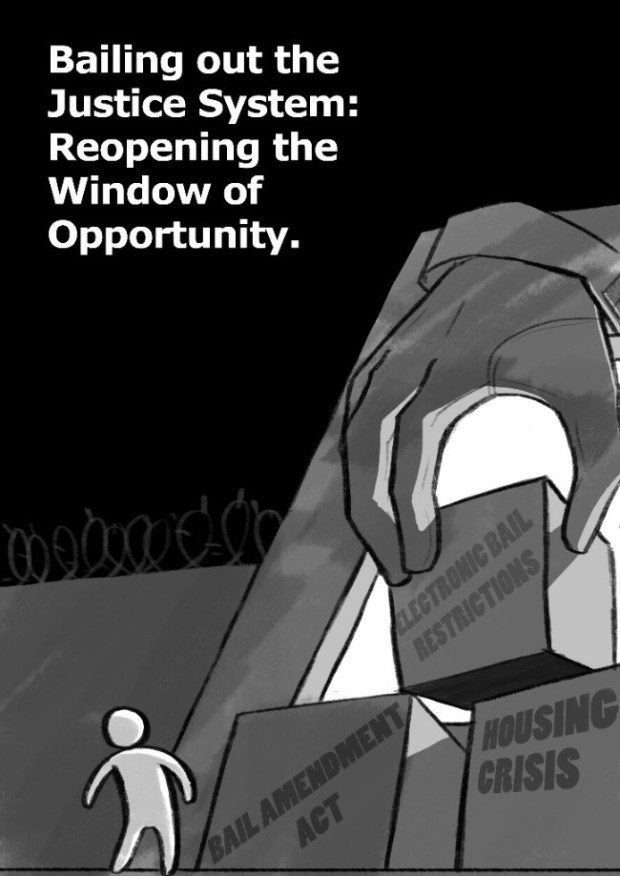

Moral and fiscal failure – take two

Let’s (not) talk about tax.

Let’s talk about the announcement of the new prison.

While your correspondent has been neglecting you dear readers – she has been heavily involved in writing this report.

It is – I hope – a relatively easy read.

Wellington peeps we are talking about it tomorrow at the Fabians. Please come.

Andrea

Shy and retiring

Let’s talk about tax.

Or more particularly let’s talk about how retirement villages don’t pay much tax.

Your correspondent has just returned from Auckland having: topped up her CPD hours; seen old friends and talked with tax peeps. And in that short period while I was away another industry was outed as being non-taxpaying. Now it is retirement villages and they aren’t even foreign.

But don’t panic. Steven Joyce says Inland Revenue is reviewing sectors of the economy which has low tax to accounting profits. And if there is a policy problem it can be put on the policy work programme. Phew.

Now as I have 5 days to complete 3 major pieces of assessment from my yoga course I have had two months to do – the sensible thing would be to put this issue down and pick it up after I have done my assessment. Coz it is not like they about to start taxpaying anytime soon.

But the issue is really interesting.

I am sure 4 days is enough to do all that other work. And I do need breaks from all that right brained stuff. I mean isn’t yoga all about balance?

So let’s have a look at the public stuff dear readers and see if we can’t unpick why these lovely people – much like our multinational friends – aren’t major contributors to the fisc. Now I know there are a few different operators but I thought I’d have a look at Ryman. Who may or may not be representative of the rest of them.

Tax actually paid

Now their tax stuff is interesting. Accounting tax expense of $3.9 million on an accounting profit of $305 million. But accounting tax expense is a total distraction if you want to know how much tax is actually paid. Why? Different rules. Future post I think.

Next place to look – imputation account which increased by $37,000. That can be real tax but can also include imputation credits from dividends received. So close but no cigar.

And then there is the oblique reference in note 4 to their tax losses in New Zealand having increased from $2.5 million in 2015 to $17.9 million in 2016. Bingo! That looks like they made a tax loss of $15 million in 2016 when they made an accounting profit of $305 million. Nice work if you can get it.

Ok now before we get into some exciting detail let’s have a think about what these retirement villages actually do. They can provide hospital services; some provide cafeterias; and they generally keep the place maintained. But mostly they ‘sell’ lifetime rights to apartments and flats on their premises.

Forgone rent

And it is this lifetime rights/apartment thing that is – in your correspondents view – the most interesting.

Looking at Ryman’s accounts and marketing material the deal seems to be residents provide an occupancy advance and get to have undisturbed use of an apartment until they ‘leave’. On ‘departure’ the right will be ‘resold’ and the former resident gets back wot they paid less some fees.

So the retirement village gets the benefit of any capital gain on the apartment as well as the benefit of forgone interest payable on the advance. All comparable to a ‘normal’ landlord who would receive the benefit of rent and capital gain on their property.

And like a ‘normal’ landlord they don’t really know how long the resident or tenant will want to stay. It could be one day or 30 years. But economically this doesn’t matter as the longer the resident stays the less in NPV terms the retirement village has to pay back. So whether landlord gets rent or repayable occupancy advance they both give the same outcome pretax and pre accounting rules. That is with rent over a long period you get lots of rent; with interest free occupancy advances over a long period you get lots of not having to pay interest.

However this isn’t how it pans out for accounting or tax.

For accounting the advances are carried at full value because they could be called immediately – occupancy advances in section j of Significant Accounting Policies. And because of this there is no time value of money benefit ever turning up in the Profit and Loss account – or what ever it is called now. Unlike rent which would get booked to the P&L when it was earned.

And tax is equally interesting. The Ryman gig seems to be that for the occupancy advance the resident gets title under the Unit Titles Act and a first mortgage for the period they are in the property. Fabulous.

Unfortunately your correspondent is about as far away from a property lawyer as it comes. But according to my property law advisor Wikipedia; a leasehold estate is where a person holds a temporary right to occupy land. Kinda looks like what is happening here. So that would be taxable under the land provisons. And even if it isn’t taxable there – to your correspondent – it looks pretty taxable as business income.

But in either case that involves taxing the entire advance and not just the interest benefit. Seems a bit mean.

Deductions

True. But let’s look at deductions before we call meanness.

Tax deductions are allowed when expenses are incurred or legally committed to. Not when actually paid. So if you are a yoga teacher and you commit to a Tiffany Cruikshank course in Cadiz in May 2017 – she is here in Wellington ATM so exciting – paying the USD 500 deposit in April 2016 you can take a deduction for the full amount of USD 2790 in the 2016/17 tax year. Even though you don’t pay it until closer to the actual course. Tax geeks yeah I am talking about Mitsubshi.

So for our retirement village friends as they are committed to repaying the occupancy advance in the future on the day they receive it. Immediate deductibility which cancels any taxable income. Mmm.

Tbf though the tax act isn’t big on the whole time value of money thing.

Financial arrangement rules

The exception is the financial arrangement rules where embedded interest can be spread over the term of the loan. And there is even a specific determination that deals with retirement villages. Now that seems to have more bells and whistles than is obvious from Ryman’s accounts so not entirely sure it relates to them. But there is one bit that could apply as the determination does say that the repayable occupancy advance is considered to be a loan.

Except even this gives no taxable income. This is because value coming in is compared to expected value going out. And of course THEY ARE THE SAME AMOUNT! So nowt to bring in as income.

Fixing it

Fixing this gap it would involve imputing some form of interest benefit that was in lieu of rent. But what interest rate to use? What is the term? And then there is the whole thing that no one actually sees it as a lease agreement. Everyone sees it as ‘ownership’ with a guaranteed sale price back.

Also entirely possible that what I consider to be blindingly obvious; cleverer people than me may consider to be – well – wrong.

Interest deductions

Then we get to much more old school techniques interest deductions to earn capital gains. And here Ryman seems to capitalise interest into new builds – section e of Significant Accounting Policies – rather than expense it for accounting. So there will be whole bunch of interest expense that isn’t in the P&L that will be on the tax return.

Unrealised capital gains

And finally thanks to NZ IRFS 13 – really does roll off the tongue doesn’t it – their accounting profits note 7 include a bunch of revaluations on their investment properties which I am guessing is the apartments. Bugg€r with this is that even a realised capital gains tax wouldn’t touch this and doesn’t look like these guys sell. Gareth’s thing though would work a treat as all the unrealised gains are on the balance sheet.

So here we have a property business that gets interest deductions; doesn’t pay tax on its capital gains or its imputed rent. Gains go on the P&L but not the interest expense. All while being totally compliant with tax and accounting.

No wonder they are share market darlings.

Andrea

Update

Thinking about the occupancy advances some more – depending on the counterfactual – maybe the value is in the tax system already as a reduced interest deduction.

The properties need funding somehow. Usually the options are debt which generates a deductible interest payment; equity which is subject to imputation or a combination of both. Here the assets are partially funded by the interest free occupancy advance. If the residents just paid rent – the assets would then need more capital. This could be completely debt funded which would mostly offset the rental income. May even exceed it if there was an expectation of a large capital gain. So while the occupancy advance is not in the tax system; neither is the extra interest deduction.

So maybe it is all an old school interest deduction for untaxed capital gain thing. But one for which a realised CGT would be useless as they don’t sell.

May need to look at Gareth’s thing again.

Fairly efficient or efficiently fair?

Let’s talk about tax.

Or more particularly let’s talk about the fairness v efficiency tension in tax policy.

You correspondent is now about two thirds through her gap year. There have been perks to not going to work. Meeting people I would never have met as a tax bureaucrat; working without getting out of bed; and morning yoga classes now being conceptually possible. And of course becoming your correspondent tops it out.

On the con side though is no income; a carefully curated wardrobe that just looks at me; and that not going to (paid) work is simply exhausting. I am the most demanding person I have ever worked for. There is no concept of downtime.

Another con as a chartered accountant is there is no benevolent employer meeting my training needs – and my CPD hours – without me realising it. So with this in mind earlier this year I arranged to attend – without credit – a postgrad course on International Tax. Two days which should sort out my CPD. Or at least push out the problem for another year. And after all those years in tax I know the benefit of deferral.

Now as a participant I need to give a talk. So I heroically offered to talk about the tension between the tax fairness people and the tax efficiency people. As at that time I thought I had reconciled them. Now not so sure. So I thought I’d riff to you dear readers and see how we go.

It is an internal discussion I regularly have – yes I really am that interesting. As in my heart I am a tax fairness person but one whose head worries about tax efficiency.

Let’s start with the wot these guys say:

Fairness people say: Everyone should pay their fair share; People should pay in proportion to their income; Tax is the price you pay for civilisation.

And Gareth has a nice general take on all this which can be paraphrased as an unfair economy is inefficient. But while I am quite attracted to that as I can’t explain it without hand waving – I won’t.

So going back to things I do understand.

Efficiency people say: New Zealand needs be an attractive place to invest; it is important tax doesn’t distort decisionmaking; company tax is a tax on labour.

Now in a domestic setting – New Zealanders using New Zealand capital employing New Zealanders; through the use of withholding taxes and imputation – efficiency and fairness cohabit happily. Wages are deductible by firms and taxable to employees. Tax is deducted by the employers on the wages and this offsets the tax liability of the employee. Company tax can be used as a credit when dividends are paid.

There is a progressive tax scale for individuals which applies no matter how they earn their income. There can be deferral benefits if money stays in a company; a concessionary PIE rate for top income earners; and interest is deductible when capital gains are earned. But all of this is cohabitation peace and harmony compared to the situation with foreign capital and New Zealand workers.

Now with foreign capital, tax paid here is next to worthless. The fairness argument is that it is that the tax is the price for using the infrastructure and educated workforce paid for from taxation. Reasonable argument but problem is that the use of that stuff is not conditional on paying tax. Classic public good/freerider thing in economics which is supposed to be stopped through the use of taxation. Mmmm.

And foreign countries give no credit for company tax paid here. They might give credit for withholding taxes but there is this whole ‘excess foreign tax credit thing’ that means they don’t. For serious tax nerds, yes there is the underlying foreign tax credit given by the US when dividends come back. But we all know how much they come back. So foreign tax is a net cost of doing business. And like all costs something they will minimise if they can.

This becomes all the more compounded when the foreign investor is a charity or pension fund or sovereign wealth fund and doesn’t pay even tax in their home country.

So then the options are invest through deductible debt or pay tax but only invest if expected return is high enough to allow for paying tax.

Right. Then so how do we get the price of civilisation thing actually paid? Working on the assumption that foreign investment is good – when I think the analysis is a bit more nuanced than that – do we just have to suck up lower foreign investment if we want more tax paid?

If only we had some New Zealand based studies to see what happened? Oh yeah we do. Company tax was cut once by Dr Cullen and then again by Hon Bill.

Did we see an uptick in foreign investment? Nah – according to Inland Revenue foreign investment as a percentage of gross domestic product pretty much didn’t change.

Now of course there is a lot of noise in that; not the least that it happened over the GFC where normal rules did not apply. And Inland Revenue did have a go at reconciling all the stuff. Maybe.

But the best expanation I ever got for tax and how it influences foreign investment came from a tax mergers and acquisitions person I met during my time inside. They said there are two types of foreign investment:

- Normal foreign businesses who are looking to buy an equivalent New Zealand business. They make their decisons to purchase based on the headline tax rate and say the headline thin capitalisation ratios. Once that decison is make the tax people then swing in and look to minimise the tax further.

- The second type was the private equity lot for whom minimising tax was very much part of their MO. They turn up with elaborate templates – which include tax savings – which then all fed into the decision to purchase and at what price.

Is this right? Dunno but it has always made sense to me. And helps explain the often ‘inconclusive results’ found when two sets of behaviours are blended in any data set.

And who do the private equity lot include? Pension funds, sovereign wealth funds and charities who have zero tax rates.

Ok so what does all of this mean to tax fairness people? I think what it means is be aware that the zero tax rate of significant international investors combined with the internationally lighter taxation of income from capital – none of which is addressed in the OECD BEPS project – mean that getting tax off foreigners may bounce back on locals in the form of higher prices or reduced investment.

To the tax efficiency people though – settle down – any impact is not one for one. The Inland Revenue stuff does show that there is a degree of taxation that is just sucked up by the owners of capital. Coz ultimately all business income comes from people who can get a bit p!ssed if they think you are free riding on their taxes paid infrastructure. And maybe they’ll spend their money somewhere else. Assuming of course that there is a taxpaying alternative coz it’s not like domestic capital is free from loopholes.

So will I say all this in my talk this week? Dunno but thanks for the chat dear readers. My head is clearer now. Thanks for listening.

Andrea

R&D again

I haven’t forgotten you dear readers. Normal transmission will return in mid May promise. But this morning when I opened my Herald app I see R&D tax incentives are being discussed again. Sigh.

But then your correspondent has friends in the big firms – all lovely people. All have mortgages and families that need feeding. And with IR Business Transformation their jobs could be at risk. Nice to know they could have something to fall back on.

Anyway dear readers I wrote about it all here. Have a read while you are waiting.

Andrea

Today Facebook

Let’s talk about tax.

Or more particularly let’s talk about Facebook and their tax payments.

The methadone programme that is this blog is working pretty well and I now have an awful lot of non blog commitments these days. So until after the Budget I will just post when I can rather than every Monday. So those of you who haven’t already – you might like to sign up to email notifications on the right of the screen. Coz dear readers I would hate for you all to miss anything I had to say.

As a further aside I am also open to topic suggestions andreataxandyoga@gmail.com altho I give no guarantee as to when they may turn up.

Now after dealing with Apple, family stuff and Sydney last week; dear readers I was and am a little tired. So as a bit of lite relief after all the nasty multinationals stuff I thought I’d finish off a post on GST I have had in the can for far too long. A reader asked for it last year but it keeps getting crowded out. Soz J.

But then this morning on my feed was a news item on Facebook and how they have very little income or tax paid in New Zealand. And how everyone who gets advertising in NZ contracts with Ireland. And they have very few staff here but earn all this money. But it’s not in their accounts.

Ok right. GST post down you go and Facebook here we come.

Now I have said a number of times there are many and varied ways of not paying tax. Apple uses a wheeze where they give the appearance of being a NZ company but because they are really an Australian company with no physical presence here they don’t pay tax here.

Looking at the 2014 accounts of Facebook New Zealand Limited and the news item Facebook’s wheeze seems to be separating out the income earning process so only some of it sticks in the New Zealand tax base.

Again once upon a time businesses advertised in newspapers or magazines that were physically based here. They would also have had a sales force that would have been a department of the newspaper or magazine probs also based in the same building as the publication.

The New Zealand company

Now the newspaper or website is in the cloud which just means a server somewhere. But there is still a sales force – or at least a sales support force – based in New Zealand. These guys are employed by Facebook New Zealand Limited a NZ incorporated company that earns fees from for its sales supporting.

Now a NZ incorporated company as you know dear readers this is prima facie taxable on all its income as it is tax resident in NZ. Ah you say but ‘what about the directors? Where is the control?’ Well done dear readers yes there are three foreign directors . Sigh. An Australian, an Irishman and a Singaporean. Beginnings of a bad joke. But good news is probs hard to show control in any one country.

So probably still resident under a treaty in New Zealand. And even if it isn’t as the sales support income is being earned from a physical presence here – note 7 shows office equipment – so probably fully taxable here. But expressions involving small mercies are coming to mind – it is only sales support income. But should be at armslength rates – usually done as a markup on cost. So there should always be taxable income here even if it is small.

The Irish company

And in the old days not only would the sales force be in NZ, the advertising contracts would be made with a NZ company. Not now. The Stuff article shows advertising agreements being made with a sister company in Ireland – Facebook Ireland Limited. This is also referenced in note 13 of the 2014 accounts so it must be true.

Now it is conceptually possible that Facebook Ireland Ltd is a NZ resident company if it had NZ directors – please stop laughing – but I am going to assume it isn’t. So let’s do the source rule thing.

Trading in v trading with

By now dear readers you will be quite expert on the whole trading in versus trading with thing. If there were no people here I would have said that this was trading with again. However the people on the ground – albeit employed by the NZ company – complicate the issue and what with the possibility that the contracts are partially completed in New Zealand. Hey I am going to give it a New Zealand source!

Limits of the permanent establishment rules

But then we go to the Irish treaty. Now the normal fixed place of business stuff can’t apply as it is Facebook NZ not Facebook Ireland that has the fixed place of business. However Article 5(5) provides that if another company – Facebook NZ – habitually enters into contracts for Facebook Ireland then game on – PE.

However your correspondent being the somewhat cynical – I have always preferred realist – individual she is is guessing the line is: ‘Dude they don’t conclude contracts for us – they are just like sales support – you know like preparatory and auxiliary. All the like real commercial work is done in Ireland not New Zealand – so bog off Mrs Commissioner.’

Tax Avoidance

Yeah that is a bit clever and yeah that is what the tax avoidance provisons are for. And we can’t assume that the Department isn’t trying to use them.

Diverted Profits Tax – NZ style

Now PE avoidance is exactly how this all appears to your correspondent and that is what the government’s proposals are trying to counter. So lets see how that goes. Tests are:

First point check – Facebook Ireland supplies advertising to NZ businesses;

Second point check – Facebook NZ does sales support;

Third point check – seems unlikely that only $1million was sales revenue in 2014

Fourth point – Ah.

The Irish treaty was concluded in 1988 long before BEPS; the international tax rules were only just coming in; and the Commissioner engaged in trench warfare that became the basis of the Winebox. Number 4 might be a bit of a struggle.

This struggle is alluded to in the discussion document’s technical appendix. Apple is example 1 and Facebook example 3. Example 3 discusses the application of the DPT NZ style and says it really is only any good if new treaties get new PE articles. And then says that maybe some countries won’t want them. Let’s all take an educated guess what Ireland will think.

But don’t panic. The OECD is doing some work on this which should come out in 2020. Awesome but wasn’t this exacly what Action point 1 was all about?

Alternative approaches

Changing the subject slightly last week Gareth Morgan put out his international tax policy. Most proposals were either the existing law – payments must be armslength or won’t get deduction – or government proposals – burden of proof should be on taxpayer. But his key point of difference is he wants all treaties ‘wound back’. I am not there yet but good on him for putting it on the table.

And given the public anger on all of this and OECD not reporting until 2020 when it was one of the original primary issues with the BEPS project – I would watch this space!

Final aside

All this discussion on Facebook is only possible because until 2014 they had to file accounts with Companies Office. This changed in 2015 to large companies only. Because compliance costs. They still have to file accounts with IRD but rest of us don’t get to see them and their related party transactions anymore.

Andrea

Apple turnover

Let’s talk about tax.

Or more particularly let’s talk about Apple and their taxes.

Your correspondent is currently in Sydney – family stuff nothing glamorous or exciting – and had started to put together a post on Donald Trump and his 2005 tax return. Coz the Sydney Morning Herald had actually explained some stuff behind it and there were some issues that I thought – dear readers – you would find interesting.

But Saturday morning I opened my Herald app to find the latest on multinationals and tax. Apple this time. And yeah that is me. Apparently they have paid no tax in New Zealand. Whether that is 100% true only the Department would know but from looking at the accounts and how it has organised itself – looks pretty damn likely.

So how did they do? Now dear readers – you are ready for this – you know about:

So let’s go!

Tax residence

Apple appears to sell products to New Zealand through a New Zealand incorporated company called Apple Sales New Zealand. Note no Ltd at the end. It is owned by an Australian company Apple Pty Ltd.

Now normally a New Zealand incorporated company means New Zealand has full taxing rights on all its income. No need to consider whether income has a NZ source or not . If it has earned income it is taxable. Well that is unless a tax treaty would take away some of those rights. And how could that happen dear readers? Yes that’s right – if it is managed or has directors control in another country.

And is Apple Sales New Zealand (not limited) controlled offshore? Yup the directors are Australian. Ok so then not a New Zealand company for tax purposes.

Source rules

Now all the income comes from New Zealand so it should be taxed here – right? Well yeah if it has a New Zealand source. And remember that trading in v trading with thing again. Now once upon a time if you wanted to sell almost a billion dollars worth of consumer products you would kinda need to be here. But now http://www.apple.com/nz/ does the business. So thanks to the internet trading in can morph into trading with meaning bye bye income tax base.

Limits of diverted profits tax

Oh but the new things announced by Hon Judith should fix it? You know the diverted profits tax – NZ style? Well not really. The NZ diverted profits tax has some use if there really is stuff happening in New Zealand but clever things have happened to make it look like there isn’t. But here there isn’t stuff happening in NZ. Just people buying stuff from a website.

And remember how all the things a diverted profits tax would help with? Remember how trading with v trading in wasn’t one of them? Yeah this won’t save us.

Tax Avoidance

But the pretending to be a New Zealand company when it is an Australian company. That is a bit cute isn’t it and doesn’t tax avoidance stop cute stuff. Yes it does so what are the facts?

- New Zealand incorporated company

- Australian directors with Australian control

- US website

- Shipping from Australia

- GST registered

- No presence or activity in New Zealand

So taking away any clever stuff. What is actually happening?

An Australian company is selling products to New Zealand via the internet shipping from a warehouse in Australia. What is the tax consequence of this? No tax – as Apple is only trading with New Zealanders not trading in New Zealand.

Compare to current outcome – no tax. Soz nothing for tax avoidance to bite on.

Could it be fixed?

Yup.

Of course it is possible Apple will get shamed into paying tax here. Putting in New Zealand directors would do the trick. Not holding my breath though. There are also plans by the Government to strengthen our source rules – but nothing proposed tho that will bite on this issue.

What would need to happen is an extension of the ‘contracts made in New Zealand’ rule to say it is deemed to be made in the country of the purchaser for online sales.

So technically not hard.

But here’s the thing. If we do that for Apple – other countries might then do it to Fonterra; Zespri; Fisher and Paykel; Fletcher Building; and Rank when they trade without a footprint. And in this case Apple NZ seems to be paying some tax in Australia. So that will be an interesting discussion with the Australian Treasury.

And it won’t just be the nasty multinationals that get caught. Your correspondent has an extensive vintage reproduction wardrobe. All purchased online from the US and UK from relatively small companies. Risk is such suppliers would see NZ as not worth the effort and stop selling to us. But then now I live in active wear not such an issue for me.

Oh and the not limited thing? It will be a US check the box company as will the Australian Pty company meaning it is an entity hybrid and Apple Inc can choose how to treat it for tax. Cool – but don’t think it impacts on us. Phew.

Andrea

Update

Thanks to a comment below – I missed a point I really shouldn’t have.

Even if we do change our source rules every treaty we have requires there to be a permanent establishment or fixed place of business before business income can be taxed. So if our source rules were expanded to make income prima facie taxable in NZ the treaty would then allocate taxing rights to Australia.

So short of resinding our treaties – or shaming Apple into paying tax here – we have to suck it up.

There is also the issue of whether it is right to expect tax given Apple isn’t using anything that taxes have paid for. But currently that seems like an argument from another time given the public outrage.

So while taxes are inherently unilateral – this is something that has to be sorted multilaterally. Except I am not aware of any real work on it. And on that I would love to be proved wrong!